- Home »

- Business Bankruptcy »

- Dealing with Corporate Distress 07: Chapter 11 is Not Always the Answer: Strategic Alternatives For and Against Distressed Businesses

Dealing with Corporate Distress 07: Chapter 11 is Not Always the Answer: Strategic Alternatives For and Against Distressed Businesses

The ABCs of ABCs, Business Bankruptcy, & Corporate Restructuring/Insolvency

In Installment 5, we walked through the lifecycle of a hypothetical traditional chapter 11, and in Installment 6 we discussed key concepts you must comprehend in order to understand any chapter 11 case.

Now we pull the camera back and turn our focus away from chapter 11 specifically, to look more broadly at the options available to a company (that is, a “debtor”) and to its various constituents (e.g., creditors and equity owners) when that company is experiencing financial distress so severe that continuing on with business as usual without a resolution is not viable.

As a threshold matter, you should understand a common misconception about the panoply of options: while some are commonly considered to be debtor alternatives, and others are commonly considered to be creditor remedies, the truth is far more nuanced. In other words, some alternatives that are usually considered to be debtor tools may also be used by creditors to achieve their goals. Likewise, some alternatives that are usually thought of as creditor remedies may be utilized by debtors to achieve their goals or the goals of their equity holders. And, so, with this in mind, here are all of the alternatives you have likely heard of, without regard to who the driver of each one is:

|

||

|

|

|

|

||

|

|

|

|

|

|

The listing above isn’t in any particular order, nor have we grouped them into categories like we could (and do elsewhere in this series). For example, an out-of-court exchange offer and an out-of-court composition agreement are both examples of an out-of-court restructuring. Another example: a state court receivership is often an outgrowth from a real estate foreclosure case. So, think of the listing above as post-it notes attached indiscriminately to the wall, without order or context. If you want those things, then go back and start with Installment 1.

One more note: the word “bankruptcy” is often used imprecisely to the point of being wrong. A company is not “bankrupt” merely because it is insolvent (a company need not even be insolvent to file bankruptcy, by the way). Nor is a company “bankrupt” because it went out of business, all of its assets were sold, and there was not enough money to pay all its creditors. A company is “bankrupt” if it files for bankruptcy protection (or if an involuntary bankruptcy petition is filed against it and an order for relief is subsequently granted) under Title 11 of the United States Code, which is the Bankruptcy Code (and, by the way, a bankrupt company is not referred to as a “bankrupt” anywhere in the Bankruptcy Code, nor in modern bankruptcy law. It is a “debtor.”)

That said, many of the principles developed in bankruptcy law exist in non-bankruptcy alternatives and, likewise, many of the attorneys and other professionals who work in corporate bankruptcy also work with its alternatives.

Subchapter V of Chapter 11

Chapter 11 affords the greatest possible relief from creditor action, potentially allowing a company to regain its footing or otherwise wind itself down in an orderly manner. Why then, have non-chapter 11 options become so much more popular over the past decade or two?

Imagine, for a moment, a troubled company as a living body that has an infected toe. While the surest way to stop the infection may be to cut off the toe, other, less costly, and less invasive treatments are available.

A traditional chapter 11 is potent, but relatively expensive. It requires an immense amount of time, not only from management, but from specialized professionals (like us) assisting the business as it operates in, and navigates through, bankruptcy. In chapter 11, a business is also required to live in a proverbial “fish bowl,” publicly filing extensive disclosures regarding its business operations and financial affairs.

What if, however, the troubled company can get all the advantages of chapter 11 at a fraction of the cost and time? Subchapter V of chapter 11, enacted in 2019 and effective since early 2020, aims to do that just that: push eligible troubled companies away from non-chapter 11 alternatives and back into the arms of the Bankruptcy Code for relief. Time will tell as to how effective this option can be.

You can also read more about subchapter V in Subchapter V of Chapter 11: A User’s Guide and Rich Man, Poor Man . . . Hurry Up, Man: Wash Away Personal Guarantees Quickly.

Which Road to Take?

The very reason there are so many alternatives to bankruptcy is that each alternative has its place. That is, depending on the circumstances and any given party’s perspective, one alternative will be considered to be the best road to go down by that party. The expression, “where you stand depends on where you sit” is apt.

The party who gets to decide what alternative will be used will vary, based on a number of variables too numerous to list here. Two “all else being equal” rules of thumb will have to suffice for now:

- If the debtor (again, we always mean the distressed company when we say “debtor”) has a war chest of cash, then it is more likely to decide where and how to drive.

- If a secured creditor has a senior lien on all of the debtor’s assets, and it is owed far more than the debtor’s assets are worth, then it is more likely to decide where and how to drive.

So, if your company is a party-in-interest in a distressed situation, the alternative you would like to see pursued will depend on what you want to achieve, and your ability to influence the decision will vary depending on your leverage.

Who Are You?

1. The Debtor

The distressed company itself is certainly a party-in-interest in its own restructuring, though where the line is between the entity and its equity owners raises an entirely different issue of fiduciary duties. That issue is beyond the scope of this installment. Regardless, for purposes of dealing with a distressed company, there is no question that the company itself has objectives of its own, as determined, manifested, and furthered by a properly advised board of directors (or LLC, LP, LLP equivalent) acting in a manner consistent with its fiduciary duties. And, based on these duties, such a board must determine the best course of action for the company, be it reorganization or liquidation, and the best means to achieve that goal.

2. Equity Owner of the Debtor

Ideally, you’d like to keep your equity in your troubled business, or at least most of it. If that’s not possible under the circumstances, then you (at the very least) do not want to have to reach into your own pocket to pay your business’s creditors from your own personal assets (whether because of a personal guaranty, an indemnification obligation, statute, piercing of the corporate veil, or breach of a fiduciary duty). Depending on your circumstances, you may have other goals. These may include matters of reputation and relationships.

3. Bank or Other Lender

First and foremost, you want to be repaid (or not, if you loaned to own). You don’t want to spend more than you must to be repaid. Beyond this, you want to make sure any collateral securing your loan isn’t losing value while you’re working to get repaid, and that you aren’t exposed to liability to a borrower’s other creditors in the process.

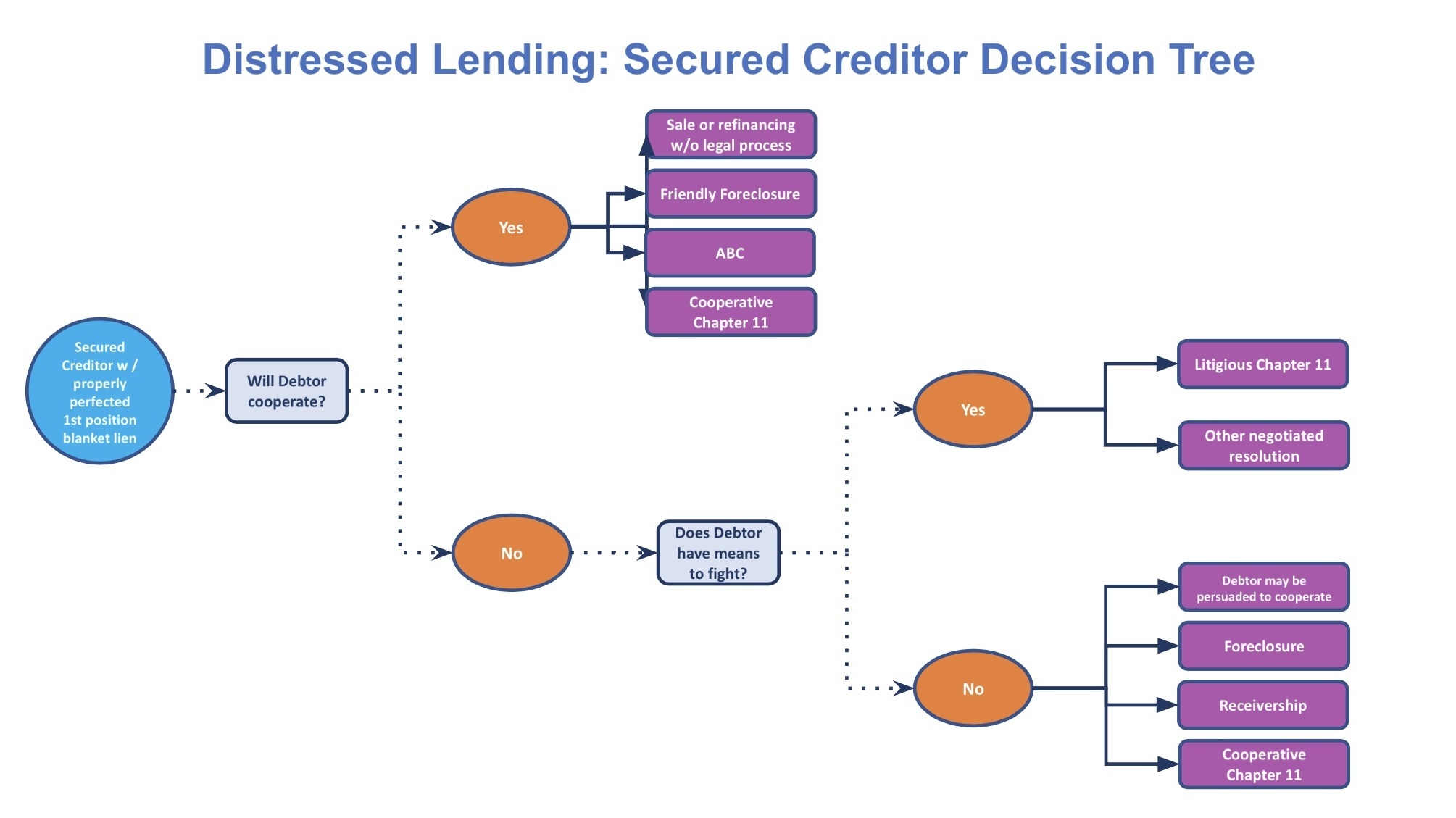

You have a lot of options at your disposal, depending on your particular facts on the ground. The following chart maps out (in broad strokes) some of your options:

4. C-Suite Executive

In a perfect world, you’d likely like to keep your position and turn your company around. But if the proverbial writing is on the wall, and your company is in distress, you’d like to keep things quiet for professional and reputational reasons so that you aren’t hindered when making your next career move. Additionally, you want to avoid incurring personal liability in your role as an officer or director of your company, especially if you’re in the so-called “zone of insolvency.” Finally, you may want some hazard pay for sticking around what may be a sinking ship.

5. Trade Vendor

You want your customers to stay in business so you can continue working with them and collect outstanding accounts receivable (which may be aging into oblivion) as quickly as possible. You also want to make sure you keep your own business from sliding into distress, because you haven’t been able to collect from a distressed customer (especially if the customer represents significant revenues to your business).

On the flip side, you want to reduce any risk that payments you do receive from your distressed customer are not going to be subjected to claw-back litigation at a later date.

6. Landlord

Landlords are a type of trade vendor, but they have unique rights and burdens under the Bankruptcy Code and under at least some ABC state law.

7. Buyer

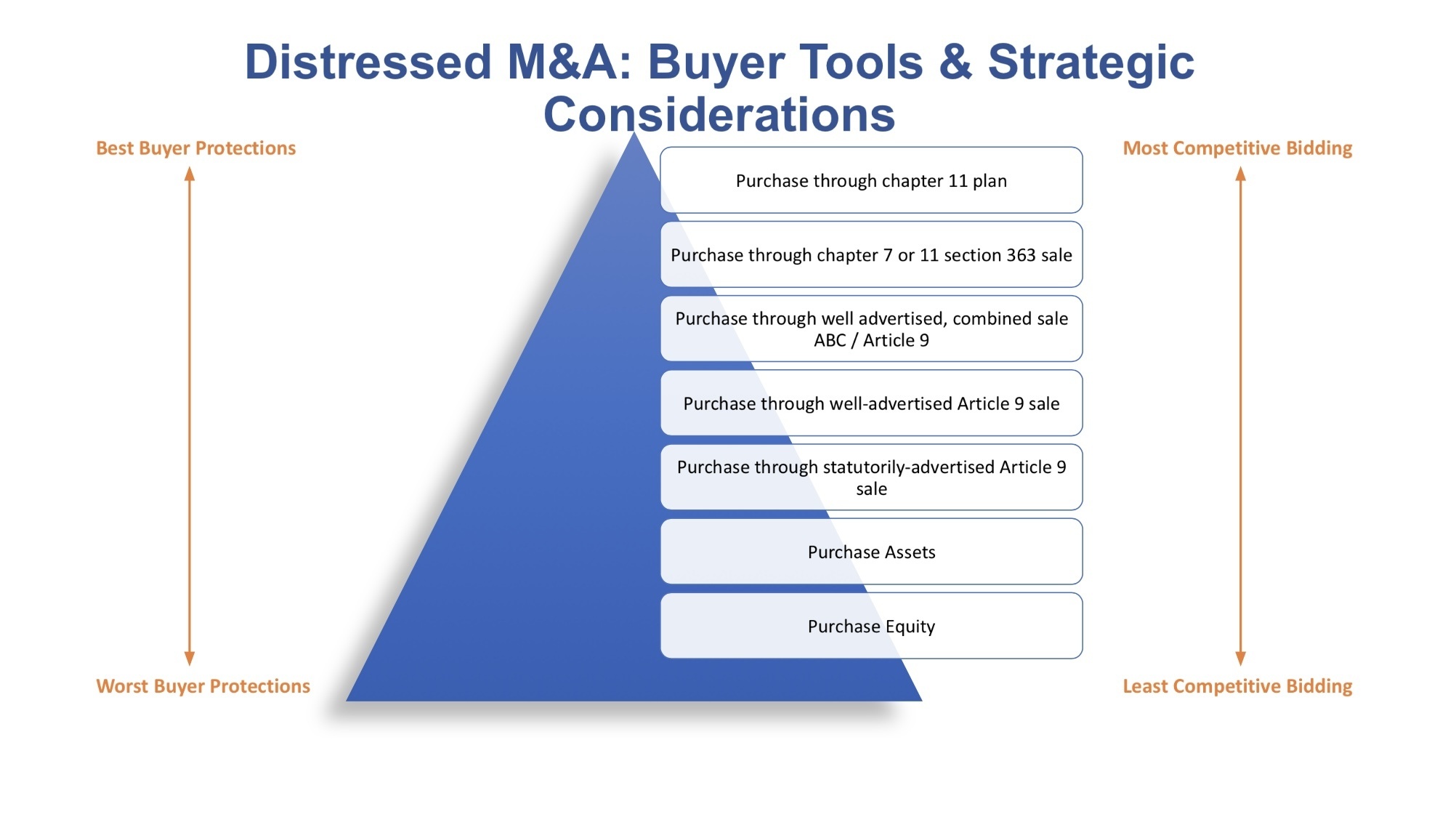

You’re looking for a good deal at a good price. And you want the “cleanest” title to assets you can get (if it’s an asset acquisition you’re after), with as little competition for those assets as possible (this introduces a strategic push-pull, as illustrated below, because “cleaner” title often comes at the cost of a more competitive acquisition process). In the context of a healthy M&A deal, a buyer is often able to make a purchase without a competitive bidding process. But in a distressed acquisition, buyers must almost always engage in some sort of competitive bidding process before a deal can be done.

Distressed M&A deals also carry special risks not generally associated with a “healthy” M&A transaction. Generally speaking, these risks can be indemnified-against by some party with deep pockets in a healthy transaction. But in a distress situation indemnification is often worthless, and buyers must therefore:

- Be willing to assume these risks, which may include claims that the buyer is liable to a debtor’s creditors for things like fraudulent transfer claims, successor liability, and other potential legal issues; or

- Seek to mitigate these risks by engaging in a more competitive process.

Here is a visual that lays this out:

As you can see, where you stand in a distress situation indeed depends on where you sit. The following series of charts should also prove useful in understanding the options available to various parties, depending on their respective posture.

Summary of Some Common Alternatives

The Insolvency Decision Tree illustrates the most common alternatives to bankruptcy (as well as chapter 11 itself), and key differences between how each alternative generally operates in relation to others.

Understanding the various alternatives is essential. Regardless of which party you are (or which party you represent), any consensual deal that any other party proposes needs to be analyzed by comparing it to what you (or your client) will get and the risks you will face in the absence of the deal that is proposed. Also, a party may elect and effect one alternative to preempt another party from pursuing another alternative. For example, a debtor may file chapter 11 to block an Article 9 UCC foreclosure by a secured party or a debtor may commence an ABC as a way to try to stave off an effective involuntary bankruptcy by unsecured creditors or to neutralize a citation to discover assets by a single creditor in certain states.

Summarizing Some Common Non-Bankruptcy Alternatives to Chapter 11

With the foregoing as background, we briefly discuss some of the most common chapter 11 alternatives available for and against distressed businesses.

Out-of-Court Workouts

Workouts have become a common route for solving a company’s financial problems when the company is struggling—but viable—and has relatively few creditors to deal with. As the name suggests, out-of-court workouts are handled outside the supervision of a court. In a workout, a debtor and its creditors informally and privately negotiate repayment terms and conditions under which the debtor repays creditors on a modified basis.

Distressed Asset or Equity Sales

Another way to avoid bankruptcy, before things get too bad for a debtor, is to run a sale process. When a business is overleveraged, it may engage in an investment banking process (you’ll remember the investment bankers from Installment 3). Through this process, the debtor seeks to either sell its assets or a significant—likely controlling—equity stake in its business to a buyer with deep pockets, capable of paying down the debtor’s obligations. The buyer gives the business enough financial runway to continue operating, while simultaneously giving creditors comfort that they’ll continue being paid in the future.

The key benefit to a sale process is to relieve a troubled business from onerous debt obligations that may otherwise bury a good business. Creditors will be happy that they are being paid, but the cost to the debtor may be considerable—resulting in a loss of control for current ownership, either because the existing business will no longer own its assets, or because the existing owners’ equity in the debtor selling will be significantly diluted, resulting in a loss of control over the direction of the business’s future.

Assignments for the Benefit of Creditors (“ABCs”)

Sometimes the writing is on the wall: a business in distress has no choice but to wind down operations, but doesn’t want to incur the expense of a controlled wind down in chapter 11. An “Assignment for the Benefit of Creditors,” or an “ABC,” is similar to a chapter 7 bankruptcy in that the company effectively hands all its assets over to a trustee, who then sells all the assets and distributes the proceeds to creditors. However, the trustee in an ABC is not a chapter 7 trustee but, rather, is a private party selected and appointed by the owners or board of the company itself. In contrast to the Bankruptcy Code (federal law), an ABC is governed by state law.1

Receivership

Receiverships represent a final option. Receiverships are (generally) creatures of state law, and are most often sought by secured lenders seeking equitable remedies against a defaulting borrower. While receiverships vary from state to state, they are generally granted by a court order (meaning the creditor seeking appointment of a “receiver,” will first have to file a lawsuit against the debtor-business).

The receivership process is generally less public than a chapter 11 case, and likely less costly for all parties involved. The major drawbacks for debtors as to receiverships are, of course, loss of control over the distressed business, and no automatic stay is imposed against debtor’s creditors (the order appointing the receiver generally stays the receivership proceeding from interfering with the receivership).2

[Editors’ Note: This article, while written to be read and understood on a standalone basis, is part of a series. To read Installment 1, which includes a table of contents and links to every article in the series, click here.

The authors are corporate restructuring and insolvency attorneys. Read more about three of them at the end of Installment 1.

Understanding all this stuff in the context of bankruptcy is important, but not every distressed company winds up in bankruptcy. So, you also need to understand how it works outside of bankruptcy. Read Installment 8 to read the rest of the story.

To learn more about this and related topics, you may want to attend the following on-demand webinars (which you can listen to at your leisure and each includes a comprehensive customer PowerPoint about the topic):

©2021. DailyDACTM, LLC d/b/a/ Financial PoiseTM. This article is subject to the disclaimers found here.

- See Geoffrey L. Berman and Steven L. Victor, An Overview of Assignments for the Benefit of Creditors, in STRATEGIC ALTERNATIVES FOR AND AGAINST DISTRESSED BUSINESSES §§ 8:1 et seq. (Jonathan P. Friedland ed., 2021). The authors of this article want to thank Geoffrey Berman, author of General Assignments for the Benefit of Creditors: The ABCs of ABCs, whose excellent work on ABCs served as the inspiration for Strategic Alternatives For And Against Distressed Businesses.

- See Robert A. Hammeke, State Court Receiverships, and Gary Marsh and Alan Long, Federal Court Receiverships, in STRATEGIC ALTERNATIVES FOR AND AGAINST DISTRESSED BUSINESSES §§ 11:1 et seq and §§ 12:1 et seq (Jonathan P. Friedland ed., 2021).

About Jonathan Friedland

Jonathan Friedland is a principal at Much Shelist. He is ranked AV® Preeminent™ by Martindale.com, has been repeatedly recognized as a “SuperLawyer” by Leading Lawyers Magazine, is rated 10/10 by AVVO, and has received numerous other accolades. He has been profiled, interviewed, and/or quoted in publications such as Buyouts Magazine; Smart Business Magazine; The M&A…

About Jack O'Connor

Jack is a corporate and restructuring partner at Levenfeld Pearlstein. Jack’s practice covers a range of healthy and distressed business engagements. He is widely recognized for his excellent work as a restructuring attorney including recognition by various organizations for his strategic thinking and tactical expertise, including SuperLawyers Magazine, Leading Lawyers Magazine, and the Turnaround Management…

About Hajar Jouglaf

Hajar is an associate with Much Shelist in both its Business Transactions Group and its Restructuring & Insolvency Group.

Related Articles

PUBLIC NOTICE OF CHAPTER 11 SALE: Solar Biotech, Inc.

90 Second Lesson: Stalking Horse Bid, Yay or Neigh?

Dealing with Corporate Distress 19: Buying & Selling Distressed Businesses in Bankruptcy: An Overview of Bankruptcy Code § 363

90 Second Lesson: First Step Before Buying a Distressed Business

Determining Whether or Not to Seek Court Approval of a Sale in a Delaware Assignment for the Benefit of Creditors Case

Dealing with Corporate Distress 18: Buying & Selling Distressed Businesses

Session expired

Please log in again. The login page will open in a new tab. After logging in you can close it and return to this page.