- Home »

- Asset Sale

Asset Sale

A stalking horse bidder makes the first bid in an bankruptcy auction, setting the initial price and structure of the sale– but there are some disadvantages.

Dealing with Corporate Distress 19: Buying & Selling Distressed Businesses in Bankruptcy: An Overview of Bankruptcy Code § 363

A distressed business has a multitude of options to explore. Understand how Bankruptcy Code Section 363 works during a business bankruptcy.

Ordinary asset purchase? Article 9 sale? Bankruptcy acquisition? When buying a distressed business, the type of purchase should be top of mind.

Determining Whether or Not to Seek Court Approval of a Sale in a Delaware Assignment for the Benefit of Creditors Case

In a Delaware assignment for the benefit of creditors case, court approval is not required for a sale, but, time, money, and preference can factor.

Sellers and buyers must know the key elements of selling a distressed business outside of bankruptcy. Levels of protection vary on both sides.

In this installment we introduce you to the UCC generally, focusing on Article 9 to illustrate its importance in the context of business distress.

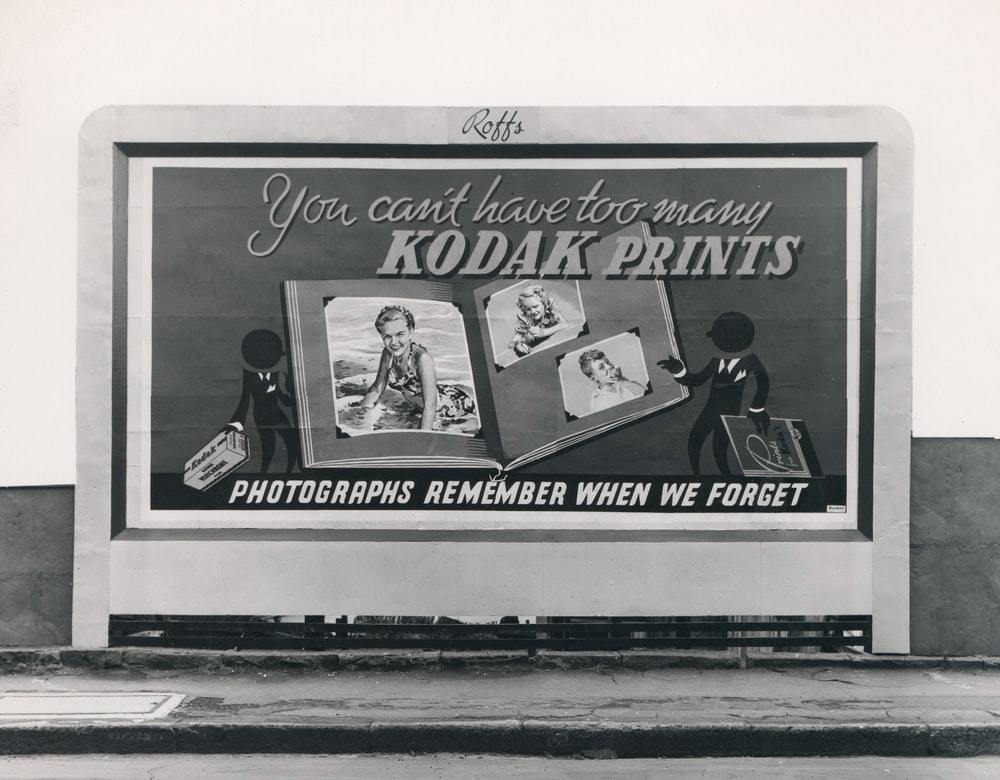

What Companies Can Do to Protect Their IP Rights in Bankruptcy The Kodak case brought into sharp focus the treatment of intellectual property rights in bankruptcy. Inventor of the roll-film hand camera in 1888 and maker of the first digital camera, the iconic company licensed thousands of patents in its extensive patent portfolio, estimated at $4.5 billion. In 2012, Kodak filed bankruptcy and sold its assets—at apparent fire-sale prices—in bankruptcy court in New York. Sale of a patent portfolio of that size affects the rights of hundreds, if not thousands, […]

Dealing with Corporate Distress 07: Chapter 11 is Not Always the Answer: Strategic Alternatives For and Against Distressed Businesses

The ABCs of ABCs, Business Bankruptcy, & Corporate Restructuring/Insolvency In Installment 5, we walked through the lifecycle of a hypothetical traditional chapter 11, and in Installment 6 we discussed key concepts you must comprehend in order to understand any chapter 11 case. Now we pull the camera back and turn our focus away from chapter 11 specifically, to look more broadly at the options available to a company (that is, a “debtor”) and to its various constituents (e.g., creditors and equity owners) when that company is experiencing financial distress so […]

What Distressed Asset Investors Can Glean from Low Interest Rates, Rising Asset Prices and Insolvency on the Horizon DailyDAC readers know that we try to confine ourselves to publishing “evergreen” thought leadership—general education for business owners and investors about business bankruptcy, its alternatives, and related subjects. There isn’t a stark line between the news of the day about the Markets and the Economy, on the one hand, and the world that is our stock and trade. We have, in the past few weeks, had a number of conversations with some […]

The Chief Restructuring Officer (CRO): From Restructuring to Stakeholder Management, They Can Do It All

An Introduction to the Distressed Company’s Superman: The Chief Restructuring Officer The role of a Chief Restructuring Officer (“CRO”) is approximately four decades old. While still a somewhat new role in the 1990s, CROs are now ubiquitous in the restructuring community. Todd Zywicki, a George Mason law professor who specializes in bankruptcy law, traces the origin of the CRO to the Bankruptcy Reform Act of 1978 (the “1978 Act”). The 1978 Act created “a unified reorganization chapter [chapter 11] that is fundamentally grounded in the presumption that pre-bankruptcy management will […]