- Home »

- Investing in Distressed Businesses

Investing in Distressed Businesses

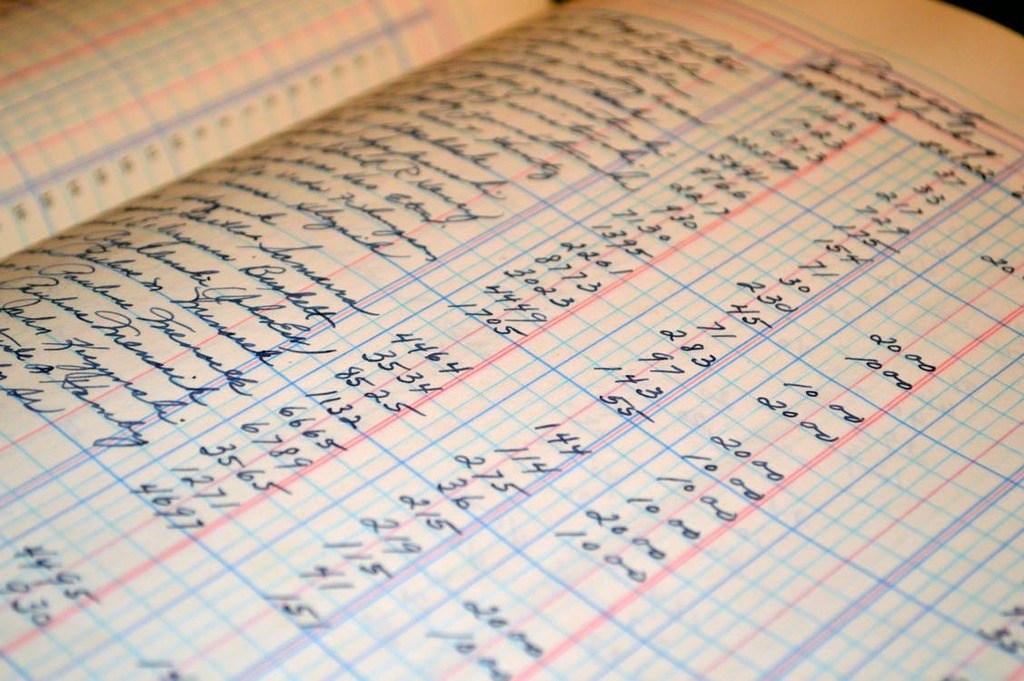

Learn how to read a balance sheet, or more importantly, how to read between the lines of the balance sheet assets, liabilities, and equity.

Investors may seek to purchase bankruptcy claims against a debtor as part of an investment strategy. What do they need to know before they invest?

Don’t expect to challenge a 363 sale so easily. Find out why you should pursue other options for purchasing assets from a distressed seller.

A stalking horse bidder makes the first bid in an bankruptcy auction, setting the initial price and structure of the sale– but there are some disadvantages.

Why would a secured creditor prefer to sell its collateral outside of bankruptcy? Here’s how time, money, and control differ in a 363 sale vs Article 9 sale.

Ordinary asset purchase? Article 9 sale? Bankruptcy acquisition? When buying a distressed business, the type of purchase should be top of mind.

An assignment for the benefit of creditors (ABC) can be a faster and more cost-effective alternative for a chapter 11 or 7 liquidation. Understand more about this alternative for selling distressed assets effectively.

Why Sell a Bankruptcy Claim? Imagine this: One of your customers sends you a notice stating it has filed for chapter 7 or chapter 11 bankruptcy protection rather than the payment for goods or services provided that you were expecting. In technical terms, you now have a “claim” against the “debtor,” but you aren’t sure you want to deal with the bankruptcy process and delay only to recover part of what you are owed. When a bankruptcy claims purchaser offers to purchase your bankruptcy claim from you for cash, you […]

New to the bankruptcy claims trading marketplace? Take a close look at documenting the purchase and sale of a bankruptcy claim.

A Primer on the Bankruptcy Claims Marketplace Upon the filing of a bankruptcy petition by a debtor in a U.S. chapter 11 proceeding, any attempts to collect debt by a creditor are halted. As a result, creditors face the daunting prospects of either waiting out the debtor’s bankruptcy case—not knowing when, how much, or even if they will ultimately recover on their claims—or engaging in what could be a drawn out and expensive dispute with the debtors to protect their right and enforce their claims. Believe It…or Not…There is an […]