- Home »

- Claims Trading

Claims Trading

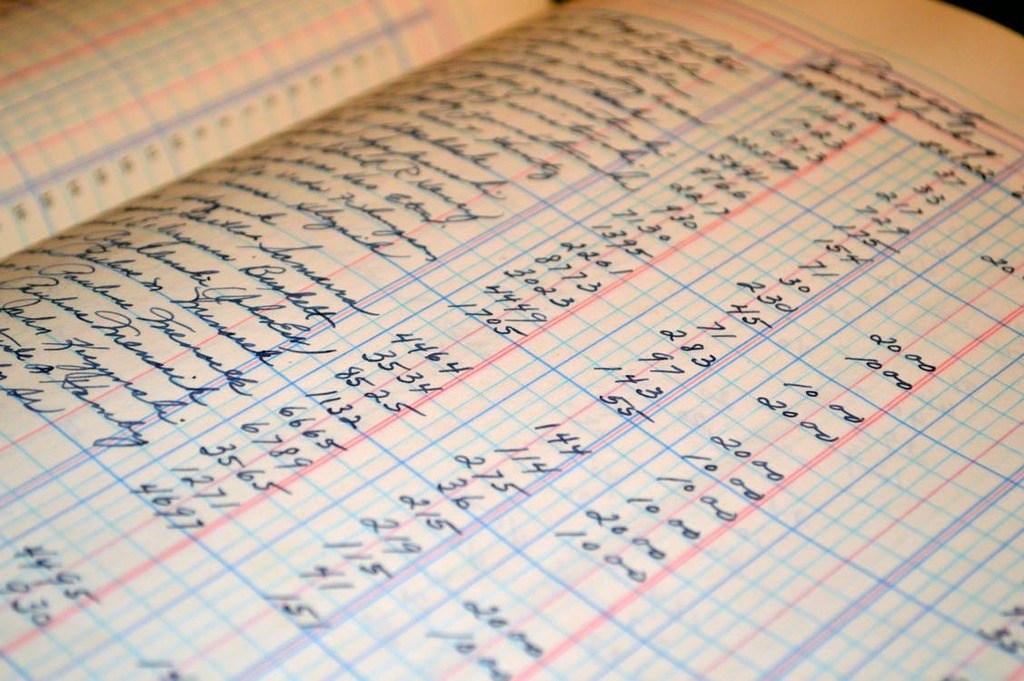

Learn how to read a balance sheet, or more importantly, how to read between the lines of the balance sheet assets, liabilities, and equity.

Investors may seek to purchase bankruptcy claims against a debtor as part of an investment strategy. What do they need to know before they invest?

Bernard Madoff’s infamous Ponzi scheme left victims in its wake worldwide and resulted in numerous bankruptcy and insolvency proceedings around the world. How far can the trustee’s power reach?

The Spokane Country Club bankruptcy case (SCC, the club, or the debtor) is an interesting study. The bankruptcy process was used to disrupt the collection efforts of plaintiff creditors who had been awarded a judgment and to negate the club’s significant policy changes that had been stipulated in a state court proceeding. The club was founded in Spokane, Washington, in 1898. Spokane is located on the far eastern side of Washington State, closer to Missoula, MT, than to Seattle. The city is named after the Native American Spokane people, whose […]

Why Sell a Bankruptcy Claim? Imagine this: One of your customers sends you a notice stating it has filed for chapter 7 or chapter 11 bankruptcy protection rather than the payment for goods or services provided that you were expecting. In technical terms, you now have a “claim” against the “debtor,” but you aren’t sure you want to deal with the bankruptcy process and delay only to recover part of what you are owed. When a bankruptcy claims purchaser offers to purchase your bankruptcy claim from you for cash, you […]

New to the bankruptcy claims trading marketplace? Take a close look at documenting the purchase and sale of a bankruptcy claim.

A Primer on the Bankruptcy Claims Marketplace Upon the filing of a bankruptcy petition by a debtor in a U.S. chapter 11 proceeding, any attempts to collect debt by a creditor are halted. As a result, creditors face the daunting prospects of either waiting out the debtor’s bankruptcy case—not knowing when, how much, or even if they will ultimately recover on their claims—or engaging in what could be a drawn out and expensive dispute with the debtors to protect their right and enforce their claims. Believe It…or Not…There is an […]

What Distressed Asset Investors Can Glean from Low Interest Rates, Rising Asset Prices and Insolvency on the Horizon DailyDAC readers know that we try to confine ourselves to publishing “evergreen” thought leadership—general education for business owners and investors about business bankruptcy, its alternatives, and related subjects. There isn’t a stark line between the news of the day about the Markets and the Economy, on the one hand, and the world that is our stock and trade. We have, in the past few weeks, had a number of conversations with some […]

Considerations for Distressed Private Equity You are a PE fund manager. Your fund employs a loan-to-own strategy (also referred to as distressed private equity) to effect take-overs of target companies. You are accustomed to exerting powerful leverage in chapter 11 cases, particularly when you buy enough claims to confirm a plan or to block confirmation of a plan by other parties. For a plan to be approved consensually, each class of claims or interests must approve it. Approval by a class of claims requires a “yes” vote by a […]

In the realm of lending, the perfected Uniform Commercial Code-1 (“UCC-1”) is the hallmark of security. If a secured asset has value, and the liens are valid, what other issues are there to consider? Well, in at least one instance, underlying intercompany notes were the issue. And because of the nature of these notes, the perfected UCC-1 lost its shine. In a bankruptcy case filed in the 5th District, the U.S. Debtor parent company had a number of lending agreements with different banks. Subsidiaries of the parent company, including foreign […]