- Home »

- Investing in Distressed Businesses

Investing in Distressed Businesses

Just Because a 363 Sale Says Free and Clear, Does Not Mean It’s True A bankruptcy debtor is offering commercial property in a section 363 sale. It is an attractive property and Lou is considering purchasing it. Lou has heard that a section 363(b) sale “cleans” the assets of all liens, claims, and encumbrances. However, he is skeptical that this is the case and is hesitating on making an offer to purchase the property. Lou’s skepticism is well-founded. There are cases where the property sold in a section 363 sale […]

What Distressed Asset Investors Can Glean from Low Interest Rates, Rising Asset Prices and Insolvency on the Horizon DailyDAC readers know that we try to confine ourselves to publishing “evergreen” thought leadership—general education for business owners and investors about business bankruptcy, its alternatives, and related subjects. There isn’t a stark line between the news of the day about the Markets and the Economy, on the one hand, and the world that is our stock and trade. We have, in the past few weeks, had a number of conversations with some […]

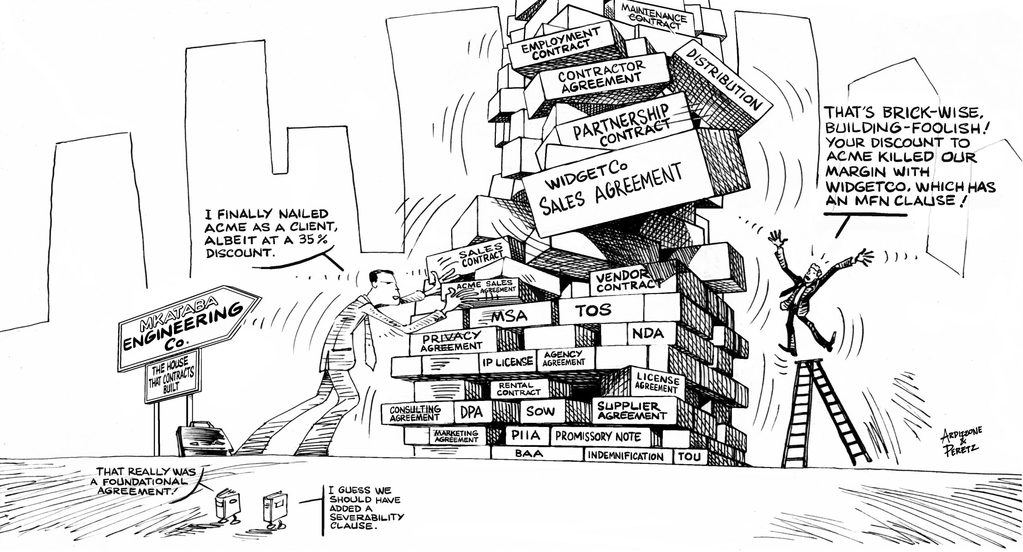

The Overlooked (Giant) Asset Class: Executory Contracts In today’s world, one of the most important sources of assets and liabilities for a debtor is its executory contracts. Companies that were once heavy with assets and employees now have a much lighter balance sheet accompanied by many more business agreements enabling (or causing) them to utilize certain assets and services, exercise particular rights and options, and fulfill certain requirements. Financial engineering and more specialized capital markets have turned monolithic companies into asset-light entities reliant on leased space, equipment, and even leased […]

With the sharp slowdown in the economy, bank stocks have declined significantly, and, unlike the broad S&P 500 Index, have not recovered much of their lost value. Year-to-date, our universe of 180 bank stocks has declined 31%, compared to the 6% decline in the broad market. Driving the weak shares are concerns over higher credit losses, particularly in commercial real estate and small/medium business loans. Banks have begun to increase their reserves, but the extent of further losses is not fully known. A new accounting rule (Current Expected Credit Losses, […]

How You Can Use Your Personal Experience and Expertise to Formulate and Investment Thesis It’s time to take an in-depth look at distressed debt investing and how you can use your personal experience in conjunction with company valuation methods to make decisions. Most investors will want to enter the distressed investing space by relying on the expertise of various funds that focus on these types of investments. Thus, I’ll address here the constraints that an individual investor faces and how one who is determined to make his or her […]

A Practical Guide to Assessing Legal Risk and Potentially Fraudulent Transfers “One man’s rubbish is another man’s treasure.” -William & Robert Chambers Journal of popular literature, science and arts (1879) “A little learning is a dangerous thing” -Alexander Pope, An Essay on Criticism (1709) Buying operating assets from a financially distressed seller can present a fantastic opportunity to buy low. Before doing so, however, any buyer must take into account a host of considerations. These include, but aren’t limited to, operational, competitive, integration and legal issues, such as […]

When a debtor files for Chapter 11 or Chapter 7 bankruptcy, often a creditor’s only remedy is to wait for a sale or reorganization, the claims resolution process and other actions to be taken before the debtor or trustee can make distribution on the claim.

Under Section 363(f) Free and Clear Means Free and Clear: A Case Study Bankruptcy sales of assets under section 363(f) can bring more cash into the estate in part because the purchaser takes the assets “free and clear” of the liabilities of the debtor-seller. The Ormet[i] case illustrates that the “free and clear” quality of assets in the hands of the purchaser after a section 363 sale, trump claims against the seller that are supported by very strong Congressional policies. Using union labor in Ohio, the Ormet Corporation and related […]