Search Results for: "DIP Loan"

A Primer on the Bankruptcy Claims Marketplace Upon the filing of a bankruptcy petition by a debtor in a U.S. chapter 11 proceeding, any attempts to collect debt by a creditor are halted. As a result, creditors face the daunting prospects of either waiting out the debtor’s bankruptcy case—not knowing when, how much, or even if they will ultimately recover on their claims—or engaging in what could be a drawn out and expensive dispute with the debtors to protect their right and enforce their claims. Believe It…or Not…There is an […]

Assignee Unknown: The Curious Cases of SmartLabs, Shine Bathroom Technologies, Liftopia, GlassPoint, SolarReserve, Maker Media, & Toymail

A curious mystery unraveled. Learn about the significant aspects of an Assignment for the Benefit of creditors, and why knowing the Assignee is important.

There Ought to Be a Law, and There Is: When the Insolvent LLC’s Manager Distributes Cash But Does Not Pay Creditors

The borrower is an LLC managed by a greedy principal member. The borrower slowly pays the secured creditor and unsecured creditors over years and its business becomes insolvent. The insolvent LLC makes cash distributions to its members, but not to the secured creditors. Is there a law against this sort of behavior?

Examining the “Fiduciary for Hire” and the NRA’s Bad Faith Bankruptcy “When in doubt, mumble, when in trouble, delegate, when in charge, ponder.” – James H. Boren, When In Doubt, Mumble: A Bureaucrat’s Handbook (1972) Business entity debtors in chapter 11 cases come in all shapes and sizes, with varying degrees of integrity and competence in managing those entities. Debtor’s professionals, while arguably also fitting those parameters, must play the cards they are dealt—usually in financially urgent circumstances—and make real-time strategic decisions with real-world consequences. When questions arise as to […]

The ABCs of ABCs, Business Bankruptcy & Corporate Restructuring/Insolvency In this installment, we take you on a tour of the time leading up to the filing of a chapter 11 case and the days that immediately follow. Mostly, we’re referring to first day motions. Before we dive into first day motions, however, you should understand that a debtor and its professionals are typically doing many other things immediately before and after they file a chapter 11 petition. For example: Continuing to explore alternatives to chapter 11 Negotiating with various parties […]

Considerations for Companies in a Cash Crisis A liquidity crisis is a severe financial situation in which a company does not have enough cash or cash-convertible assets, which can lead to defaults and bankruptcy. Managing cash is critical when working to preserve or maintain solvency in order to maximize opportunities for a successful turnaround or corporate restructuring. Near-Death Liquidity Is Like a Melting Ice Cube Insufficient liquidity shrinks the range of options for a financially distressed business. The metaphor of a melting ice cube is often used to illustrate this […]

The ABCs of ABCs, Business Bankruptcy, & Corporate Restructuring/Insolvency In the last two installments of this series, we introduced you to things a company should consider before deciding whether to file chapter 11, and a timeline for understanding how a “typical” chapter 11 case proceeds. In this quick little ditty, we want to make sure you understand four concepts that permeate every chapter 11 case except, perhaps, a prepack. 1. The Automatic Stay When a bankruptcy case is filed, an “automatic stay,” is triggered under Bankruptcy Code § 362. The automatic […]

The ABCs of ABCs, Business Bankruptcy & Corporate Restructuring/Insolvency [Authors’ Note: Before going any further, read Installment 4: Chapter 11—If You’ve Seen One, You’ve Seen Them All. While you can generally read any installment in this series in any order or even by itself, this one is an exception…] And now, we present to you, the five stages of a “typical” chapter 11 case (subject to the caveats you read in our previous installment). By the way, make sure you read to the end so you can see what a […]

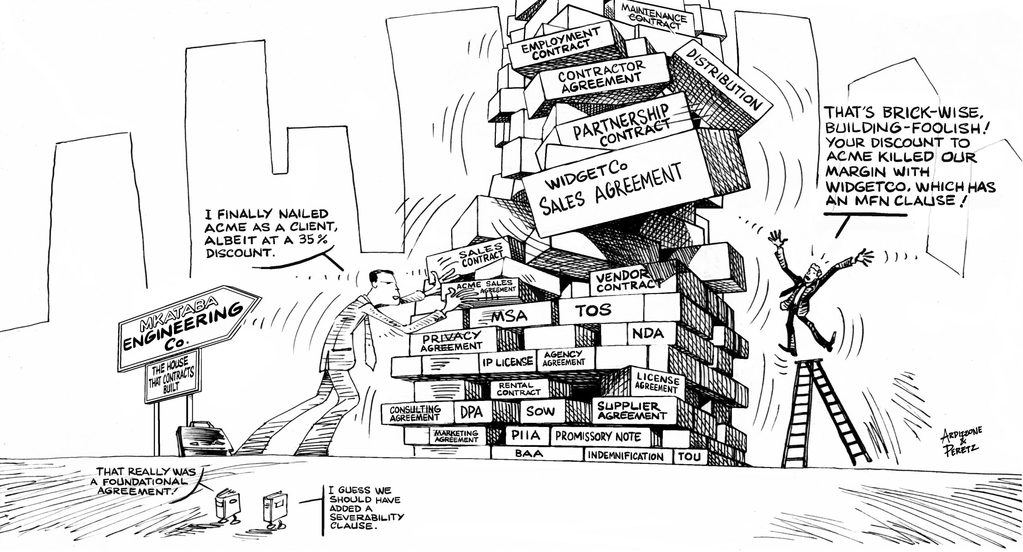

The Overlooked (Giant) Asset Class: Executory Contracts In today’s world, one of the most important sources of assets and liabilities for a debtor is its executory contracts. Companies that were once heavy with assets and employees now have a much lighter balance sheet accompanied by many more business agreements enabling (or causing) them to utilize certain assets and services, exercise particular rights and options, and fulfill certain requirements. Financial engineering and more specialized capital markets have turned monolithic companies into asset-light entities reliant on leased space, equipment, and even leased […]

The Battle Over Post-Petition Interest for Oversecured Creditors In bankruptcy, an oversecured creditor (in which the value of its collateral is higher than its claim) is first in line to be paid. Unfortunately, oversecured creditors are also entitled to post-petition interest (interest that accrues or would accrue after the start of bankruptcy proceedings, regardless of whether or not it is allowed in the proceeding). As a debtor who successfully increases the value of the asset/collateral—how do you alleviate an increased claim and maintain liquidity? And what say does the secured […]