Search Results for: "DIP Loan"

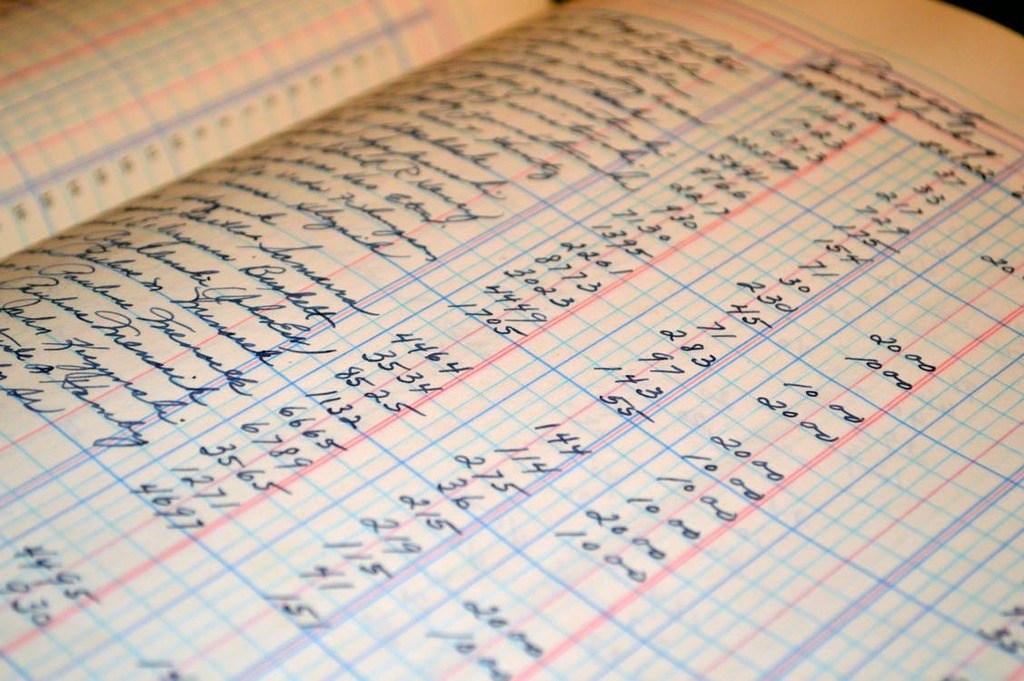

Learn how to read a balance sheet, or more importantly, how to read between the lines of the balance sheet assets, liabilities, and equity.

Subchapter V works. It saves businesses. It helps the people that own those businesses. And it is cheap and fast, at least compared to “traditional” chapter 11.

When your borrower files bankruptcy, choosing to cooperate can lead to a more successful restructuring or sale. Here’s how to protect yourself if you do.

Careless mistakes in UCC-3 terminations and continuations can lead to costly litigation with secured parties. Learn best practices for filing and recording.

It’s typical for secured lenders in a chapter 11 case to set aside a portion of the proceeds of its collateral to pay professional fees. Understand what you may need to know about carve-out fees.

Dealing with Corporate Distress 17: Focus on Assuming & Rejecting Executory Contracts & Unexpired Leases in Bankruptcy

Legal framework governing assumption, assignment, and rejection of executory contracts and unexpired leases in bankruptcy can be complicated.

What is a bankruptcy venue? A debtor should be considerate when selecting a venue to file for bankruptcy and know which eligible venues are best to file in.

Let’s take a look at bankruptcy from the secured creditor’s perspective (they play a large role in a distressed business situation). Read about what a secured creditor should know when a business files for bankruptcy.

Assignment for Benefit of Creditors (ABC) might mitigate loss and preserve going-concern value for the company and its secured creditor.

A Series on the ABCs of ABCs, when it comes to claims there’s a plethora of them. From secured to unsecured, to bankruptcy and trade. Read all the basics in this installment of Dealing with Corporate Distress. This Installment covers how to protect you claim in a bankruptcy case.