- Home »

- Business Bankruptcy

Business Bankruptcy

The Jevic case upheld the absolute priority rule, but it did not prohibit structured dismissals. How are structured dismissals affected post-Jevic?

A Series on the ABCs of ABCs, when it comes to claims there’s a plethora of them. From secured, to unsecured, to bankruptcy, and trade. Read all the basics in this installment of Dealing with Corporate Distress.

A creditor may seek appointment of a chapter 11 trustee in replacement of the debtor in possession, but there are special considerations to make first.

Bankruptcy Reporting Requirements Before and During Chapter 11 One of the central principles of bankruptcy is that a debtor should have the benefit of a “fresh start.” However, to accord such relief, the Bankruptcy Code, Bankruptcy Rules, and case law require transparency from the debtor and other parties in interest. As such, strict compliance with bankruptcy reporting requirements is a primary responsibility of a debtor in possession (DIP). Courts expect a DIP to keep proper records and file required disclosures and reports in a timely manner. A DIP’s failure to […]

Examining the “Fiduciary for Hire” and the NRA’s Bad Faith Bankruptcy “When in doubt, mumble, when in trouble, delegate, when in charge, ponder.” – James H. Boren, When In Doubt, Mumble: A Bureaucrat’s Handbook (1972) Business entity debtors in chapter 11 cases come in all shapes and sizes, with varying degrees of integrity and competence in managing those entities. Debtor’s professionals, while arguably also fitting those parameters, must play the cards they are dealt—usually in financially urgent circumstances—and make real-time strategic decisions with real-world consequences. When questions arise as to […]

The Nuts & Bolts of Ipso Facto Clauses and Golden Share Arrangements That May Sidestep the Bankruptcy Code’s Prohibition

When are Ipso Facto Clauses and Golden Share Arrangements Enforceable in Bankruptcy? “Termination on bankruptcy” provisions—ipso facto clauses—are commonly used in many types of business contracts, providing for the termination of the contract (either automatic or at the non-debtor party’s election) upon the obligor’s filing of bankruptcy or the occurrence of similar events or conditions. However, generally, such clauses are not enforceable in the bankruptcy context, because as a matter of policy, debtors should be allowed access to the protections accorded to debtors under the Bankruptcy Code. In some types […]

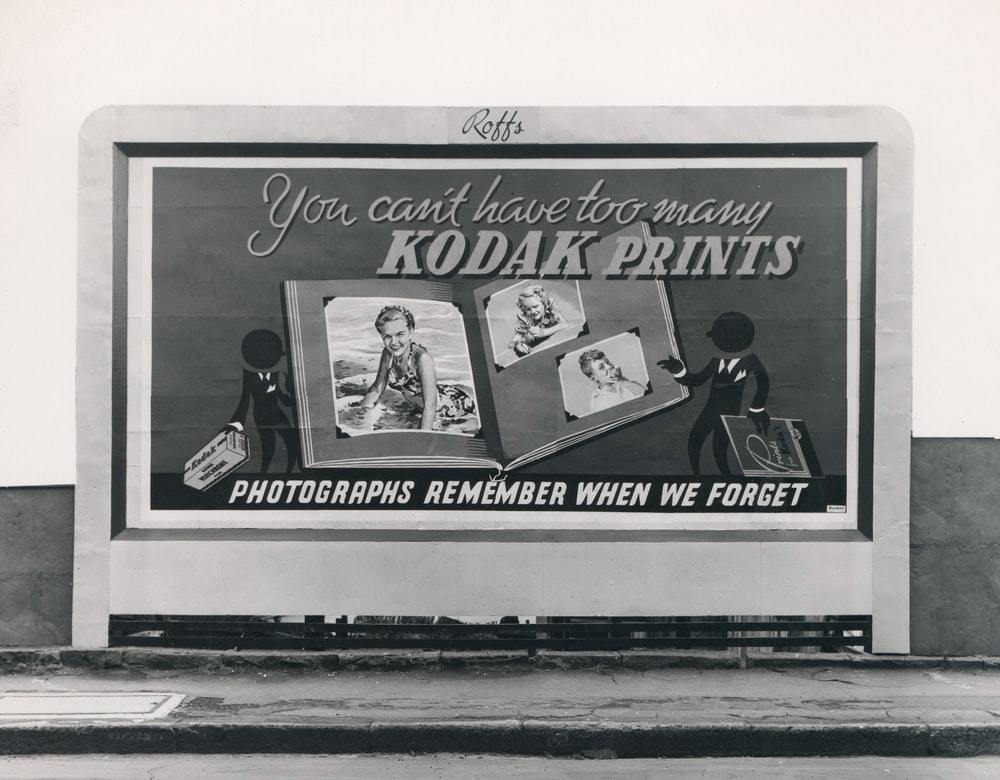

What Companies Can Do to Protect Their IP Rights in Bankruptcy The Kodak case brought into sharp focus the treatment of intellectual property rights in bankruptcy. Inventor of the roll-film hand camera in 1888 and maker of the first digital camera, the iconic company licensed thousands of patents in its extensive patent portfolio, estimated at $4.5 billion. In 2012, Kodak filed bankruptcy and sold its assets—at apparent fire-sale prices—in bankruptcy court in New York. Sale of a patent portfolio of that size affects the rights of hundreds, if not thousands, […]

The ABCs of ABCs, Business Bankruptcy & Corporate Restructuring/Insolvency In this installment, we take you on a tour of the time leading up to the filing of a chapter 11 case and the days that immediately follow. Mostly, we’re referring to first day motions. Before we dive into first day motions, however, you should understand that a debtor and its professionals are typically doing many other things immediately before and after they file a chapter 11 petition. For example: Continuing to explore alternatives to chapter 11 Negotiating with various parties […]

Considerations for Companies in a Cash Crisis A liquidity crisis is a severe financial situation in which a company does not have enough cash or cash-convertible assets, which can lead to defaults and bankruptcy. Managing cash is critical when working to preserve or maintain solvency in order to maximize opportunities for a successful turnaround or corporate restructuring. Near-Death Liquidity Is Like a Melting Ice Cube Insufficient liquidity shrinks the range of options for a financially distressed business. The metaphor of a melting ice cube is often used to illustrate this […]

Dealing with Corporate Distress 07: Chapter 11 is Not Always the Answer: Strategic Alternatives For and Against Distressed Businesses

The ABCs of ABCs, Business Bankruptcy, & Corporate Restructuring/Insolvency In Installment 5, we walked through the lifecycle of a hypothetical traditional chapter 11, and in Installment 6 we discussed key concepts you must comprehend in order to understand any chapter 11 case. Now we pull the camera back and turn our focus away from chapter 11 specifically, to look more broadly at the options available to a company (that is, a “debtor”) and to its various constituents (e.g., creditors and equity owners) when that company is experiencing financial distress so […]