- Home »

- Business Bankruptcy

Business Bankruptcy

The Finishing of the “Unfinished Business” Doctrine and the Jewel Waiver One of the interesting aspects of business bankruptcy cases is that both the businesses and the issues their bankruptcy proceedings present can differ so much. In recent years, for example, we have seen department stores (Macy’s, Federated), toy retailers (Toys R Us), bookstore chains (Borders), automobile manufacturers (GM, Chrysler), supermarkets (A&P), auto supply companies (Delphi), securities firms (Lehman Brothers), oil and gas E&P companies (Ultra Petroleum, Energy XXI), telecom outfits (WorldCom, Adelphia), and energy companies (Enron, EFIH) file for […]

What Distressed Businesses and Their Counsel Should Know About the Consolidated Appropriations Act 2021 and Its Effect on the Bankruptcy Code

What is the Consolidated Appropriations Act? Congress passed the Consolidated Appropriations Act, 2021 on December 21, 2020, and President Trump signed the massive act into law six days later, when it became effective. The act includes several changes to title 11 of the United States Code, which is usually called the “Bankruptcy Code,” and most changes sunset on either the first or second anniversary of the effective date of the act. Here are the changes you need to know, in the order they are presented in the act. Property That […]

The ABCs of ABCs, Business Bankruptcy & Corporate Restructuring/Insolvency [Authors’ Note: Before going any further, read Installment 4: Chapter 11—If You’ve Seen One, You’ve Seen Them All. While you can generally read any installment in this series in any order or even by itself, this one is an exception…] And now, we present to you, the five stages of a “typical” chapter 11 case (subject to the caveats you read in our previous installment). By the way, make sure you read to the end so you can see what a […]

Lender Liability Law Protects Distressed Borrowers from Unfair Practices The relationship between a lender and borrower can be complex. The borrower wants capital to run and grow its business, and the lenders want to earn a return and eventually get their principal back. If the borrower complies with the terms of the loan, all is good. If the borrower breaches, then the lender has a number of rights and remedies. Sometimes, however, a lender overreaches. One example of an overreach is when a lender exerts control over the daily activities […]

How Liquidity Becomes the Kryptonite of a Distressed Company’s Capital Structure A company’s “capital structure” is the array of its liabilities and equity. It is often described by the debt to equity ratio, which is the amount of total debt divided by total equity. Capital structure commonly consists of three main components: working capital (also known as operating debt), financing debt, and equity. Working capital, or operating debt, includes accounts payable, accrued expenses, and other current liabilities usually due within one year. Financing debt includes senior bank financing, leases, and […]

What Happens When Your Consignee Becomes Distressed and What You Can Do I was speaking with a client yesterday about consignment arrangements. What we discussed should be of interest to any company that sells goods using a consignment arrangement, and I thought I would share. What is a Consignment Arrangement? In a consignment arrangement, the consignor, as owner of the goods, delivers them to a consignee. The consignee, in turn, will try to sell those goods to customers. Be Careful Not to Mischaracterize the Proceeds You Expect from a Consignment […]

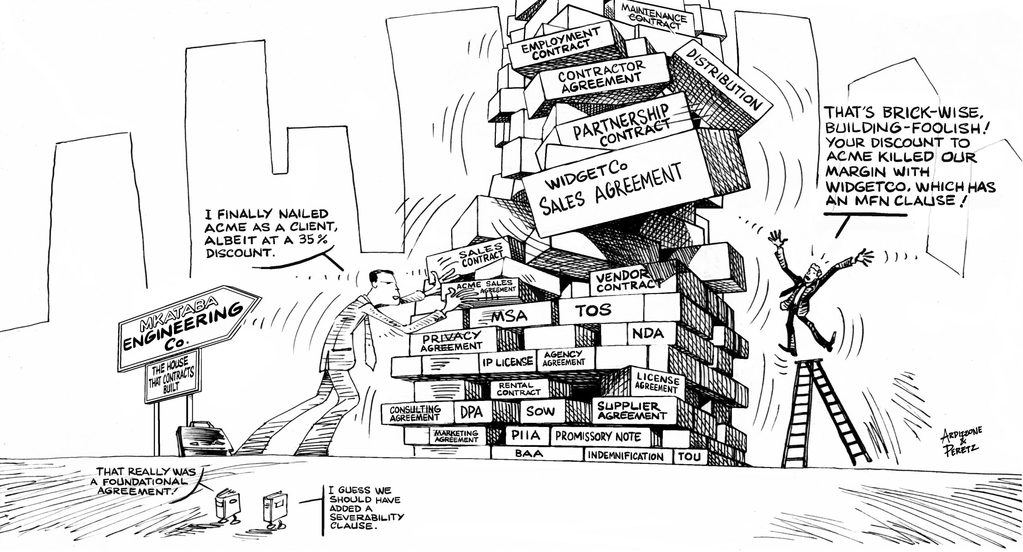

The Overlooked (Giant) Asset Class: Executory Contracts In today’s world, one of the most important sources of assets and liabilities for a debtor is its executory contracts. Companies that were once heavy with assets and employees now have a much lighter balance sheet accompanied by many more business agreements enabling (or causing) them to utilize certain assets and services, exercise particular rights and options, and fulfill certain requirements. Financial engineering and more specialized capital markets have turned monolithic companies into asset-light entities reliant on leased space, equipment, and even leased […]

Facing Personal Liability for Business Debts? Who Ya’ Gonna Call?1 People who are not bankruptcy experts but who know something about the subject tend to put all bankruptcy attorneys into one of two buckets: (a) attorneys who help people file bankruptcy; and (b) attorneys who help businesses file bankruptcy. This distinction is mostly correct. Generally speaking, there are two types of people who file bankruptcy: (a) people who incurred debt for personal or household purposes, which are “most people;” and (b) people whose debt derives from some form of business […]

The Battle Over Post-Petition Interest for Oversecured Creditors In bankruptcy, an oversecured creditor (in which the value of its collateral is higher than its claim) is first in line to be paid. Unfortunately, oversecured creditors are also entitled to post-petition interest (interest that accrues or would accrue after the start of bankruptcy proceedings, regardless of whether or not it is allowed in the proceeding). As a debtor who successfully increases the value of the asset/collateral—how do you alleviate an increased claim and maintain liquidity? And what say does the secured […]

Examining the TOUSA Case Ruling on Fraudulent Transfers One of the most powerful tools in the Bankruptcy Code available to bankruptcy trustees (or other estate representatives) to maximize the recovery of creditors is the power to avoid and recover fraudulent transfers of a debtor’s property. These include transfers that are made, or obligations that are incurred, by a debtor: “With the actual intent to hinder, delay or defraud creditors (§ 548(a)(1)(A)); or Constructively fraudulent transfers, i.e., transfers made or obligations incurred for which the debtor receives less than reasonably equivalent […]