- Home »

- 363 Sale

363 Sale

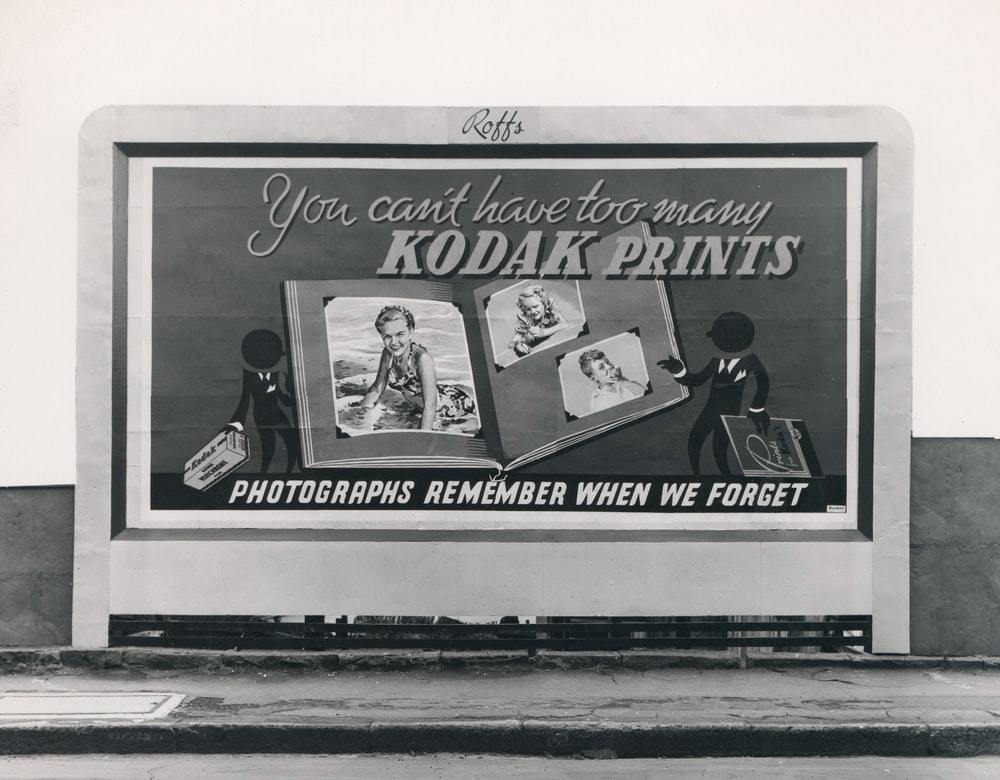

What Companies Can Do to Protect Their IP Rights in Bankruptcy The Kodak case brought into sharp focus the treatment of intellectual property rights in bankruptcy. Inventor of the roll-film hand camera in 1888 and maker of the first digital camera, the iconic company licensed thousands of patents in its extensive patent portfolio, estimated at $4.5 billion. In 2012, Kodak filed bankruptcy and sold its assets—at apparent fire-sale prices—in bankruptcy court in New York. Sale of a patent portfolio of that size affects the rights of hundreds, if not thousands, […]

Understanding the Right to Credit Bid After Radlax [Editor’s Note: this is part of our irregular series in which we answer readers’ questions. If you have a question, submit it to [email protected] and we will try to answer it.] Question A private equity investor wrote in recently asking us to address credit bidding in the aftermath of Radlax. Answer For investors who are unfamiliar with the concept, the right to credit bid is the “right of the secured creditor under the Bankruptcy Code to use its secured claim against a […]

The ABCs of ABCs, Business Bankruptcy, & Corporate Restructuring/Insolvency In the last two installments of this series, we introduced you to things a company should consider before deciding whether to file chapter 11, and a timeline for understanding how a “typical” chapter 11 case proceeds. In this quick little ditty, we want to make sure you understand four concepts that permeate every chapter 11 case except, perhaps, a prepack. 1. The Automatic Stay When a bankruptcy case is filed, an “automatic stay,” is triggered under Bankruptcy Code § 362. The automatic […]

Creative Destruction and an Inevitable Fall: What Can We Learn From the Penthouse Magazine Bankruptcy? Penthouse International, publisher of Penthouse Magazine, sold for $11.2 million in June of 2018. The company was worth about $700 million (adjusted for inflation) at its height. The latest Penthouse Magazine bankruptcy highlights just how far Penthouse has fallen, and what lessons can be learned regarding bankruptcy in general. The New Owner The buyer was WGCZ, which also owns XVideos.com and Bangbros.com. XVideos, in turn, functions as an aggregator (just as YouTube is an aggregator […]

The Battle Over Post-Petition Interest for Oversecured Creditors In bankruptcy, an oversecured creditor (in which the value of its collateral is higher than its claim) is first in line to be paid. Unfortunately, oversecured creditors are also entitled to post-petition interest (interest that accrues or would accrue after the start of bankruptcy proceedings, regardless of whether or not it is allowed in the proceeding). As a debtor who successfully increases the value of the asset/collateral—how do you alleviate an increased claim and maintain liquidity? And what say does the secured […]

How Unique Issues in Healthcare Restructuring Set It Apart from Corporate Restructuring Over the past decade, arguably no industry experienced such dramatic regulatory change or consistent legislative uncertainty as healthcare. Today, continued efforts to repeal, defund, replace, or amend the Affordable Care Act—coupled with rising pharmaceutical costs, increased competition, massive capital investment expenses, etc.—virtually assure a challenging economic environment for healthcare companies for years to come. However, given the stakes involved—and the unfortunate fact that healthcare restructuring provides little time for “on the job training”—practitioners must enter such engagements […]

Chilled Credit Bidding and the Section 363 Sale Section 363(k) of the Bankruptcy Code (the “Code”) allows a secured creditor to bid at a section 363 sale and use the amount of their claim to offset the purchase price at the sale, called “credit bidding.” A court may limit this right “for cause.” The “for cause” standard is not defined in the Code, and disagreement exists as to what constitutes “for cause.” Traditional bases for limiting credit bidding include challenges related to the lien itself, failure to correctly assert the […]

Is the Jury In or Out on Chapter 11 Bankruptcy Gifts? The gifting doctrine in bankruptcy is not new and often is used to obtain creditor consensus to a debtor’s proposed exit—either through a chapter 11 plan or a Section 363 sale. Bankruptcy “gifts” typically involve a structurally senior class voluntarily giving some of its property or distribution to a structurally junior class of creditors or equity holders. Bankruptcy courts across the nation have reached differing and, at times, seemingly inconsistent decisions regarding the gifting doctrine. Some courts view […]

Under Section 363(f) Free and Clear Means Free and Clear: A Case Study Bankruptcy sales of assets under section 363(f) can bring more cash into the estate in part because the purchaser takes the assets “free and clear” of the liabilities of the debtor-seller. The Ormet[i] case illustrates that the “free and clear” quality of assets in the hands of the purchaser after a section 363 sale, trump claims against the seller that are supported by very strong Congressional policies. Using union labor in Ohio, the Ormet Corporation and related […]

Home Owners Bargain Outlet: Section 363 Bankruptcy Asset Sale Opportunity Prior to filing Chapter 11 on October 25th Home Owner’s Bargain Outlet (“HOBO”) was a leading regional home improvement bargain retailer of “special buys” (goods that come from opportunistic purchases of a wide array of products primarily from brokers and a handful of regular vendors/manufacturers- including front-line buybacks, closeouts, overstocks, irregulars, package changes, and discontinued products), home improvement and home decor products. Think of “Home Depot meets Tuesday Morning.” Prior to its Chapter 11 filing HOBO operated seven retail locations, averaging 80,000 square feet per location, in the Chicagoland and Milwaukee metropolitan areas. HOBO’s core product categories included flooring, kitchen/bath, and furniture. Store Locations #21 West Allis Opened: May 1996 Square Feet: 59,361 + 20,000 square foot warehouse #23 Crest Hill Opened: October 1998 Square Feet: 61,056 #24 Waukegan Opened: October 1999 Square Feet: 80,160 #25 Oaklawn Opened: October 2009 […]