Search Results for: "dip financing"

Dealing with Corporate Distress 02: These Are the People in Our Neighborhood: An Overview of Parties in Chapter 11

A Series on the ABCs of ABCs, Business Bankruptcy & Corporate Restructuring/Insolvency Since a judge presides over a chapter 11 proceeding, one might assume that a chapter 11 case is like any other commercial litigation matter, with one party on each side of the case: a plaintiff and a defendant. One would be wrong (Felix Unger taught us what happens when we “ass-u-me”). In this installment of our series on business bankruptcy, restructuring and insolvency, we look at debtors, chapter 11 trustees, types of creditors and other parties involved in […]

A Series on the ABCs of ABCs, Business Bankruptcy & Corporate Restructuring/Insolvency Greetings, Dear Reader: It seems you’re interested in learning how to deal with corporate distress, and we’re glad you’re here. But let’s first make sure you got on the right plane. Maybe you… Are a C-suite executive of a business that’s considering buying a failing competitor on the cheap Manage a private equity or hedge fund Are a junior associate in the restructuring or special situations group of a law, investment banking, or accounting firm Are a credit […]

Bankruptcy Valuation Valuation—the estimation of an entity’s worth—plays a crucial role in all stages of a commercial bankruptcy, as well in any out-of-court restructuring.¹ Valuation can be critical at the beginning of a bankruptcy case in determining whether the debtor can use cash collateral or obtain debtor-in-possession financing. At the confirmation stage, valuation plays a critical role in determining whether a chapter 11 plan can be confirmed and, if so, how much each class of creditors will receive on its claim. Even after confirmation, valuation is an essential issue in […]

JPMorgan Chase & Co. and others (“JPM”) lent $1.5 billion to General Motors Corporation (“Old GM”) under a term loan agreement (the “Term Loan Agreement”). JPM was the senior secured creditor of Old GM. Old Gm went into chapter 11 bankruptcy. Under the terms of the DIP financing approved by the bankruptcy court, proceeds of the DIP loan were used to pay $1.5 billion to JPM for its claims under the Term Loan Agreement. The unsecured creditors committee formed in the Old GM chapter 11 case (the “Committee”) wants that […]

In large chapter 11 cases, the diffuse interests of a large number of creditors may be at stake. Bankruptcy law addresses potential collective action problems (see the brilliant Mancur Olsen, Jr., The Logic of Collective Action: Public Goods and the Theory of Groups (1965)) by providing that the U.S. Trustee may appoint the membership of an official committee of unsecured creditors (often called “the committee”) having a fiduciary duty to all such creditors. The committee is usually composed of an odd number of the largest unsecured creditors that are willing to serve. […]

Investors may seek to purchase bankruptcy claims against a debtor as part of an investment strategy. What do they need to know before they invest?

What rights do non-debtors have in the treatment of executory contracts? Learn about rejecting or assuming executory contracts as a non-debtor.

Assignment for Benefit of Creditors (ABC) might mitigate loss and preserve going-concern value for the company and its secured creditor.

What Happens When Your Consignee Becomes Distressed and What You Can Do I was speaking with a client yesterday about consignment arrangements. What we discussed should be of interest to any company that sells goods using a consignment arrangement, and I thought I would share. What is a Consignment Arrangement? In a consignment arrangement, the consignor, as owner of the goods, delivers them to a consignee. The consignee, in turn, will try to sell those goods to customers. Be Careful Not to Mischaracterize the Proceeds You Expect from a Consignment […]

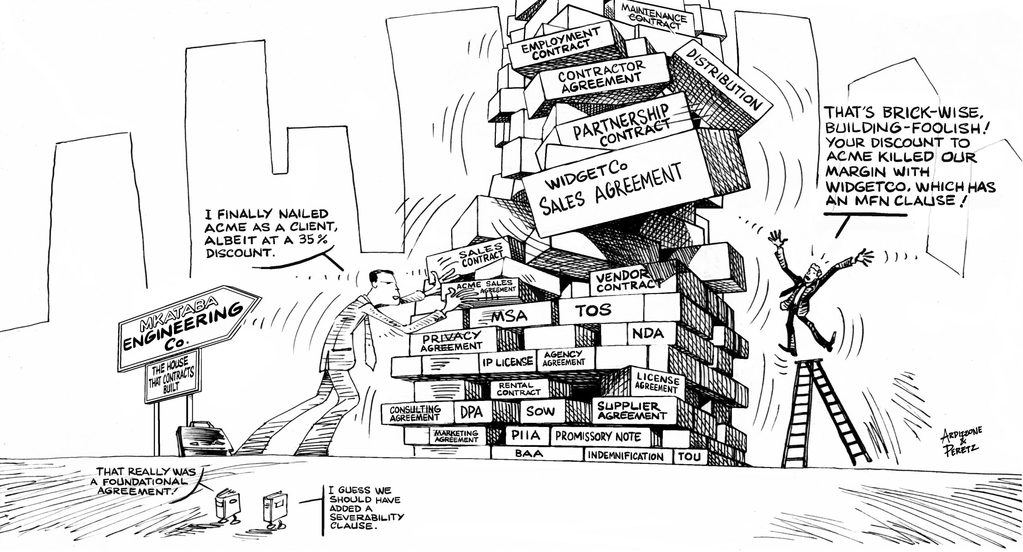

The Overlooked (Giant) Asset Class: Executory Contracts In today’s world, one of the most important sources of assets and liabilities for a debtor is its executory contracts. Companies that were once heavy with assets and employees now have a much lighter balance sheet accompanied by many more business agreements enabling (or causing) them to utilize certain assets and services, exercise particular rights and options, and fulfill certain requirements. Financial engineering and more specialized capital markets have turned monolithic companies into asset-light entities reliant on leased space, equipment, and even leased […]