Search Results for: "Section 363"

“A sale under Section 363 that takes advantage of the provisions of Section 363(f) allowing the property to be sold “free and clear of any interest in such property” under specified conditions including, most importantly, in the case of a lien, when “the price at which such property is to be sold is greater than the aggregate value of all liens on such property.” Any liens then attach to the proceeds of the sale. There is controversy over whether the Code requires that the sale price be for the entire […]

Assignment for Benefit of Creditors (ABC) might mitigate loss and preserve going-concern value for the company and its secured creditor.

“Liability imposed on the purchaser of assets for claims against the prior owner of the assets. The courts originally developed this doctrine to protect victims of personal injury torts, especially future tort claimants, where there has been a “de facto merger” or “mere continuation” of the old business by the new owner of the assets. There has been some recent extension, though less so than is generally thought, of this doctrine to include debts to providers of goods, services, or capital (lenders) to the old business. Purchasers in section 363 […]

Assignee Unknown: The Curious Cases of SmartLabs, Shine Bathroom Technologies, Liftopia, GlassPoint, SolarReserve, Maker Media, & Toymail

A curious mystery unraveled. Learn about the significant aspects of an Assignment for the Benefit of creditors, and why knowing the Assignee is important.

There Ought to Be a Law, and There Is: When the Insolvent LLC’s Manager Distributes Cash But Does Not Pay Creditors

The borrower is an LLC managed by a greedy principal member. The borrower slowly pays the secured creditor and unsecured creditors over years and its business becomes insolvent. The insolvent LLC makes cash distributions to its members, but not to the secured creditors. Is there a law against this sort of behavior?

Examining the “Fiduciary for Hire” and the NRA’s Bad Faith Bankruptcy “When in doubt, mumble, when in trouble, delegate, when in charge, ponder.” – James H. Boren, When In Doubt, Mumble: A Bureaucrat’s Handbook (1972) Business entity debtors in chapter 11 cases come in all shapes and sizes, with varying degrees of integrity and competence in managing those entities. Debtor’s professionals, while arguably also fitting those parameters, must play the cards they are dealt—usually in financially urgent circumstances—and make real-time strategic decisions with real-world consequences. When questions arise as to […]

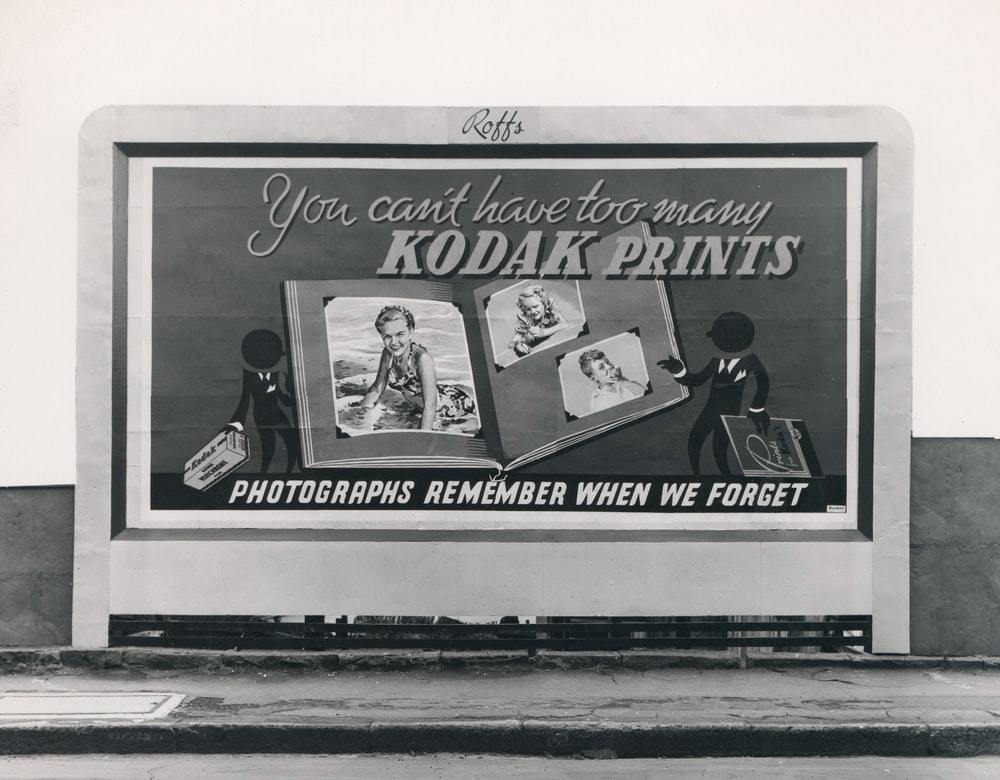

What Companies Can Do to Protect Their IP Rights in Bankruptcy The Kodak case brought into sharp focus the treatment of intellectual property rights in bankruptcy. Inventor of the roll-film hand camera in 1888 and maker of the first digital camera, the iconic company licensed thousands of patents in its extensive patent portfolio, estimated at $4.5 billion. In 2012, Kodak filed bankruptcy and sold its assets—at apparent fire-sale prices—in bankruptcy court in New York. Sale of a patent portfolio of that size affects the rights of hundreds, if not thousands, […]

UNITED STATES BANKRUPTCY COURT FOR THE NORTHERN DISTRICT OF ILLINOIS EASTERN DIVISION NOTICE OF SALE David P. Leibowitz, Chapter 7 Trustee (the “Trustee”), has obtained title to the beneficial interest in Attorneys Title Guaranty Land Trust L020-009, which land trust holds title to real estate commonly known as 2023 N. Humboldt Blvd., Chicago, IL (the “Real Estate”). The Assignment of Beneficial Interest from Ivan Diaz to Trustee was accepted by ATG Trust Company as trustee of the Land Trust on May 19, 2021. Therefore, pursuant to the Bankruptcy Court’s “ORDER GRANTING TRUSTEE’S MOTION TO AUTHORIZE SALE OF PROPERTY OF THE ESTATE FREE AND CLEAR OF LIENS, CLAIMS, INTERESTS AND ENCUMBRANCES PURSUANT TO SECTION 363(F) OF THE BANKRUPTCY CODE” entered on April 13, 2021 (Docket 80) and other orders entered on that same date, Trustee has entered into a contract to sell the Real Estate, subject to any competing offers that […]

Understanding the Right to Credit Bid After Radlax [Editor’s Note: this is part of our irregular series in which we answer readers’ questions. If you have a question, submit it to [email protected] and we will try to answer it.] Question A private equity investor wrote in recently asking us to address credit bidding in the aftermath of Radlax. Answer For investors who are unfamiliar with the concept, the right to credit bid is the “right of the secured creditor under the Bankruptcy Code to use its secured claim against a […]

The Chief Restructuring Officer (CRO): From Restructuring to Stakeholder Management, They Can Do It All

An Introduction to the Distressed Company’s Superman: The Chief Restructuring Officer The role of a Chief Restructuring Officer (“CRO”) is approximately four decades old. While still a somewhat new role in the 1990s, CROs are now ubiquitous in the restructuring community. Todd Zywicki, a George Mason law professor who specializes in bankruptcy law, traces the origin of the CRO to the Bankruptcy Reform Act of 1978 (the “1978 Act”). The 1978 Act created “a unified reorganization chapter [chapter 11] that is fundamentally grounded in the presumption that pre-bankruptcy management will […]