- Home »

- Valuation

Valuation

Knowing the collateral value of a secured claim is important. It will impact how the secured creditor is treated under the plan.

Learn how to read a balance sheet, or more importantly, how to read between the lines of the balance sheet assets, liabilities, and equity.

Do you know how much your business is worth? A business appraiser can give you an objective outsider’s view and also venture an opinion on its trajectory.

A property appraisal is useful in situations like buy/sell transactions, auctions, and liquidation sales. Learn the ins and outs, from process to pricing.

It Depends on the Facts Debtors often use Chapter 11 bankruptcy for litigation advantages. Whether or not they succeed depends on the facts and circumstances of the individual bankruptcy case. The following sample case helps to illustrate how a court may rule. Case Study Catherine, Jules, and Jim founded and each owned one-third of a company. The company thrived initially, but as the company grew, the owners fell out, with Catherine on one side and Jules and Jim on the other. Lawsuits were filed. Using a provision of their state-specific […]

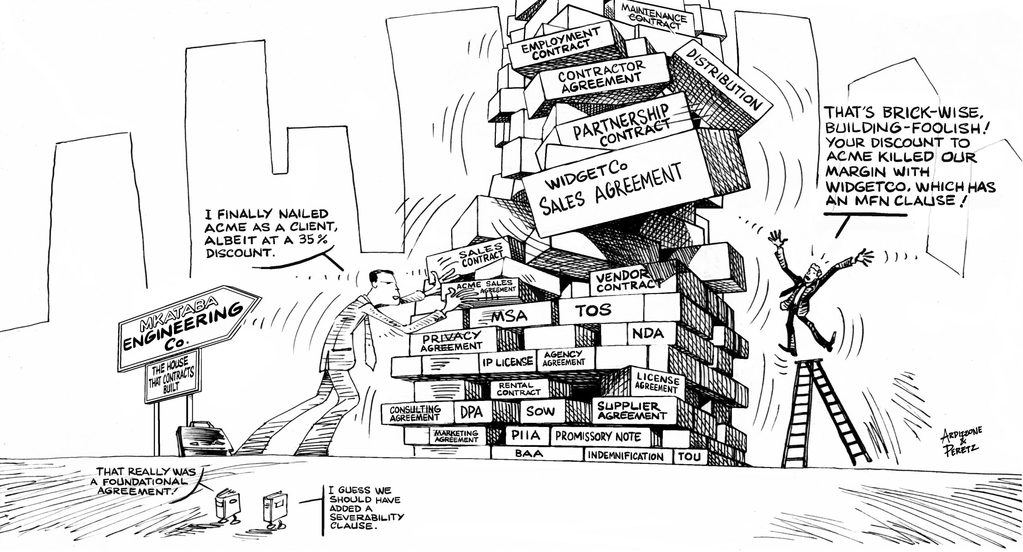

The Overlooked (Giant) Asset Class: Executory Contracts In today’s world, one of the most important sources of assets and liabilities for a debtor is its executory contracts. Companies that were once heavy with assets and employees now have a much lighter balance sheet accompanied by many more business agreements enabling (or causing) them to utilize certain assets and services, exercise particular rights and options, and fulfill certain requirements. Financial engineering and more specialized capital markets have turned monolithic companies into asset-light entities reliant on leased space, equipment, and even leased […]

Chilled Credit Bidding and the Section 363 Sale Section 363(k) of the Bankruptcy Code (the “Code”) allows a secured creditor to bid at a section 363 sale and use the amount of their claim to offset the purchase price at the sale, called “credit bidding.” A court may limit this right “for cause.” The “for cause” standard is not defined in the Code, and disagreement exists as to what constitutes “for cause.” Traditional bases for limiting credit bidding include challenges related to the lien itself, failure to correctly assert the […]

Section 1111(b) Election: A Countermeasure for Undersecured, Secured Creditors Mathew 5:29 – And if thy right eye offend thee, pluck it out, and cast it from thee: for it is profitable for thee that one of thy members should perish, and not that thy whole body should be cast into hell. In a previous article about cram downs, in which a debtor can take steps to confirm a Chapter 11 plan despite rejection from creditors, I referred briefly to an undersecured, secured creditor’s countermeasure: the section 1111(b)(2) election. By […]

Pacifying a Hostile Lender with a Motion to Substitute Collateral Can a Chapter 11 debtor confirm a plan that gives a hostile secured creditor a lien on an orange as a substitute, in essence, for the secured creditor’s lien on an apple that the debtor wants to keep and use?1 Yes, a motion to substitute collateral is valid if the value of the new lien meets the “indubitable equivalent” test with the value of the original lien. Substitute Collateral in Apples and Oranges Assume that the land-rich but cash-poor Chapter […]

How You Can Use Your Personal Experience and Expertise to Formulate and Investment Thesis It’s time to take an in-depth look at distressed debt investing and how you can use your personal experience in conjunction with company valuation methods to make decisions. Most investors will want to enter the distressed investing space by relying on the expertise of various funds that focus on these types of investments. Thus, I’ll address here the constraints that an individual investor faces and how one who is determined to make his or her […]