- Home »

- Public Notices »

- NOTICE OF BANKRUPTCY SALE: Five Environmentally Impacted Development Sites In New Jersey, Ohio & Alabama

NOTICE OF BANKRUPTCY SALE: Five Environmentally Impacted Development Sites In New Jersey, Ohio & Alabama

See Below for Photos

Offer deadline March 22, 2017. All transactions are subject to Bankruptcy Court approval.

Keen-Summit Capital Partners LLC , has been engaged by the chapter 11 estates of the debtors in the jointly-administered chapter 11 bankruptcy cases captioned In re Maxus Energy Corporation, Case No. 16-11501 (Bankr. D. Del.) as exclusive real estate broker for the offering of these 5 owned development sites. The sites are owned by debtors Maxus Energy Corporation and Tierra Solutions, Inc.

Each property is affected by environmental issues. However, all environmental concerns, such as investigation, remediation and maintenance, are the responsibility of a third party.

The Properties are located in New Jersey, Ohio and Alabama. The properties in New Jersey and Alabama are located in industrial areas and may potentially be developed for industrial purposes. The property in Ohio is located on Lake Erie and has potential for residential and recreational development. The Ohio site has approximately 200 lakefront acres that are presently remediated and ready for development. The property addresses are.

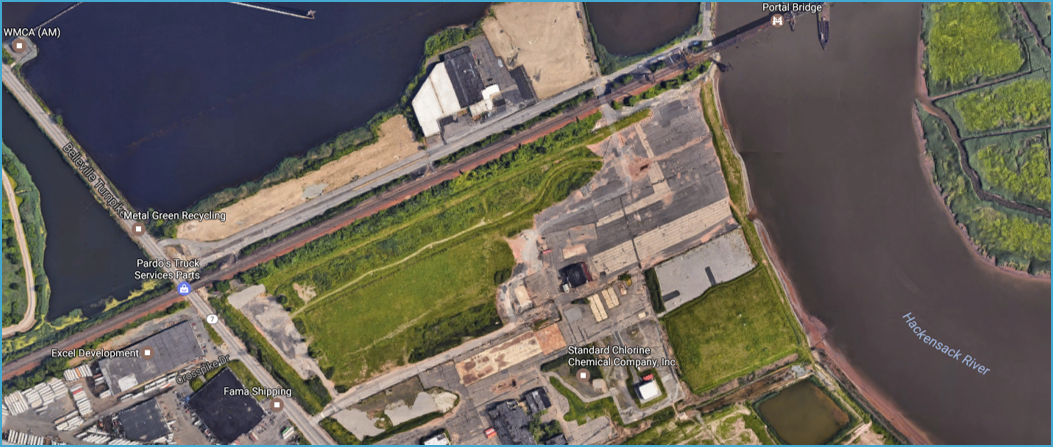

- 1015 Belleville Turnpike, Kearny, NJ: 28.65Acres Across 4 Parcels; Vacant land with access via Belleville Tpke and frontage on Belleville Tpke, Hackensack River and Amtrak railroad — Potential Industrial Development. Environmental status: Interim Containment Remedy & Continuous Monitoring

- 2 O’Brien Road, Kearny, NJ: 6.76 Acres Across 5 Parcels; Vacant land with M zoning (Manufacturing), has access from O’Brien Rd and Sellers St – Potential Industrial Development. Environmental status: Interim Containment Remedy & Continuous Monitoring

- 86-102 Lister Avenue, Newark, NJ: 5.82 Acres Across 2 Parcels; Site located along the Passaic River in Industrial Area. Environmental status: Interim Remediation Completed with on-going management

- 1200 Fairport Nursery Road, Painesville, OH: 1,038.82 Acres Across 21 Parcels w/ 200+ Ready for Development; Land is located along the Grand River and Lake Erie with 200+ lakefront acres ready for development of residential and recreational uses. Environmental status: Continuous Monitoring & Active Planning and Investigation

- 5421 Reichold Road, Tuscaloosa, AL: 16.66 Acres Across 5 Parcels; Land is adjacent to the Black Warrior River. Environmental status: Interim Remediation Completed with Continuous Maintenance & Monitoring

For photographs of the properties and more information, visit www.keen-summit.com.

Christopher Mahoney

Director

Keen Summit Capital Partners

(646) 381-9205

[email protected]

Click on Photos to Enlarge

About DailyDAC

DailyDAC™ is the internet's oldest, most trusted, and most widely used provider of public notices of asset sales and case commencements, and other important notices involving companies in financial distress in the United States and Canada. DailyDAC™ public notices are used by bankruptcy trustees, chapter 11 debtors in possession, federal and state court receivers, assignees for the benefit of creditors, auctioneers, and secured parties disposing of their collateral under the Uniform Commercial Code or other state law trust (and their respective auction firms, law firms, and other agents). Learn more.

Many sales of distressed companies and distressed business assets are not widely advertised. If you are buyer of such companies or assets, you may be well served by becoming a paying subscriber to Distressed Deal Data™. Find out more.

Related Articles

PUBLIC NOTICE OF SALE: Traffic Control Service Provider

Commercial Receivers Association (CRA) Expands its Reach to Indiana and Oregon with Announcement of New State Directors – Kevin Hamernik and Gene Buccola

PUBLIC NOTICE OF UCC ARTICLE 9 SALE: American Titanium Works LLC

PUBLIC NOTICE OF AUCTION (Pursuant to Code of Civil Procedure Section 1174(e) – (m); Civil Code Section 1990(a)-(c); Civil Code Section 1993 et. Seq.; Commercial Code Sections 9601, 9609(a) and 9613; and Code of Civil Procedure Section 697.510(a) et. Seq.): CHOL ENTERPRISES INC.

PUBLIC NOTICE OF UCC ARTICLE 9 SALE: Sky Capital Group LLC d/b/a Roady’s Truck Stops

PUBLIC NOTICE OF CHAPTER 11 SALE: Metavine, Inc.