- Home »

- Public Notices »

- PUBLIC NOTICE OF RECEIVER’S SALE: Chicagoland-Based Landscaping and Erosion Control Company

PUBLIC NOTICE OF RECEIVER’S SALE: Chicagoland-Based Landscaping and Erosion Control Company

Special Situation Acquisition Opportunity:

Special Situation Acquisition Opportunity:

Chicagoland-Based Landscaping and Erosion Control Company

COMPANY OVERVIEW

This acquisition opportunity is for a landscaping subcontractor that specializes in erosion control, hardscaping and soft-scaping services for major commercial and industrial projects in the Chicagoland area and throughout the State of Illinois and operates as a Minority Business Enterprise – Disadvantaged Business Enterprise, (the “Company”). The business was established in 2012 and has over 140 active contracts. As of September 18, 2023, the expected remaining value of the contracts was approximately $9.6MM.

The Company continues to serve its markets, maintain a loyal customer base, and distinguish itself from other companies in a highly competitive industry and geography. Representative contracts and projects include traditional commercial and residential landscaping and maintenance to more complex municipal and State of Illinois road and highway landscape maintenance and erosion control projects. The Company has 32 employees and is privately held.

SITUATION OVERVIEW

From 2021 to early 2023, the Company’s principal owner (the “Seller”) was involved in a legal dispute with former investors that was resolved in the Spring of 2023 with an adverse judgement. The Company is currently in receivership in the State of Illinois. As part of the settlement order, the Seller and former investors have agreed to market the Company for sale and collectively move on from the business. The Seller can remain involved for up to twelve months following completion of the sale to help transition contracts, relationships and employees to new ownership, as needed.

Newpoint Advisors Corporation is currently serving as the Company’s receiver and has been engaged to assist the Company in this sale process.

OPPORTUNITY

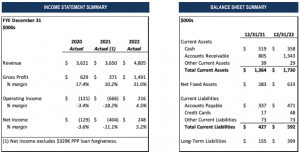

Despite the protracted legal process and unfavorable outcome to the Seller, the Company continued to win new business and execute on all its contracts. While the business does have over 140 active contracts, the Company’s QuickBooks financials have not been reliably updated since 2022. The Company, with Newpoint’s assistance, has maintained a weekly cash flow model that does track all the collections and disbursements with history dating back to March 2021 that coincides with Newpoint’s appointment as receiver. We have included summary information below and can share more detailed information upon execution of the non-disclosure agreement.

NOTE: The Company’s business plan and financials have not been audited by Newpoint Advisors Corporation and are subject to the potential investor’s due diligence. Newpoint makes no representation as to the accuracy of the Company’s financial results. The purpose of this document is to gauge interest in an acquisition of either the equity or assets of the Company described above.

About Newpoint Advisors Corporation

Newpoint Advisors Corporation is a financial advisory firm dedicated to improving troubled and financially underperforming businesses with revenues of $5MM-50MM. Our collaborative, process-oriented approach allows us to deliver objective solutions for a fixed fee and on a fixed timeline. Newpoint Advisors believes in a cooperative team approach: we work with our clients to educate them in ways that maximize profitability and growth. Please contact any members of our team if you are interested in this opportunity.

Biegel Macaraeg

[email protected]

(214) 288-1480

Camryn Douglas

[email protected]

(470) 262-5224

About DailyDAC

DailyDAC™ is the internet's oldest, most trusted, and most widely used provider of public notices of asset sales and case commencements, and other important notices involving companies in financial distress in the United States and Canada. DailyDAC™ public notices are used by bankruptcy trustees, chapter 11 debtors in possession, federal and state court receivers, assignees for the benefit of creditors, auctioneers, and secured parties disposing of their collateral under the Uniform Commercial Code or other state law trust (and their respective auction firms, law firms, and other agents). Learn more.

Many sales of distressed companies and distressed business assets are not widely advertised. If you are buyer of such companies or assets, you may be well served by becoming a paying subscriber to Distressed Deal Data™. Find out more.

Related Articles

PUBLIC NOTICE OF ASSIGNEE’S SALE: AUCTION OF ASSETS OF CHICAGO WICKER & TRADING CO.

PUBLIC NOTICE OF CHAPTER 11 SALE: Solar Biotech, Inc.

PUBLIC NOTICE OF UCC SALE: Secured Party Sale

PUBLIC NOTICE OF UCC SALE: Wildcat LLC

PUBLIC NOTICE OF UCC SALE: Pelrous Fund REIT, LLC

PUBLIC NOTICE OF UCC SALE: Indoor Cannabis Cultivating Business

Session expired

Please log in again. The login page will open in a new tab. After logging in you can close it and return to this page.