- Home »

- Public Notices »

- PUBLIC NOTICE OF ARTICLE 9 SALE: Overwatch Technologies, Inc.

PUBLIC NOTICE OF ARTICLE 9 SALE: Overwatch Technologies, Inc.

NOTICE OF PUBLIC SALE UNDER UNIFORM COMMERCIAL CODE ARTICLE 9 OF ASSETS OF OVERWATCH TECHNOLOGIES, INC.

1. Executive Summary: Clive Barrett in his capacity as trustee under certain loan documents (the “Trustee”) will conduct, through his counsel acting as its agent, Parkins Lee & Rubio LLP (the “Agent”), on August 17, 2021, at 11:00 a.m. CDT or such later date as provided below (the “Auction Date”), a disposition of the below-described collateral by public sale (the “Auction”). To participate in the Auction, you must comply with the Participation Requirements below by August 13, 2021 (the “Qualification Deadline”). The below described collateral includes substantially all intellectual property of Overwatch Technologies, Inc. d/b/a Overwatch Digital Health.

2. Debtor: The debtor is Overwatch Technologies, Inc. d/b/a Overwatch Digital Health, a Texas corporation (the “Borrower”).

3. Secured Parties: The secured parties on behalf of whom the Trustee is conducting this public sale of the Property, as defined below, are the holders of the Convertible Notes (defined below) listed on Exhibit A hereto (the “Secured Parties”).

4. Agreements and Legal Authority Pursuant to Which the Sale is Held:

- The Convertible Note Deeds and Note Certificates (together, the “Convertible Notes”) issued by Overwatch Digital Health, Inc. n/k/a Overwatch Technologies, Inc.; and

- The Security Interest Agreement dated April 10, 2019, between the Borrower and the Trustee.

The foregoing documents, along with any other documents related thereto, are collectively referred to as the “Loan Documents.” The Auction is taking place in accordance with the provisions of the Texas Uniform Commercial Code, Section 9-101 et seq. (the “UCC”) as a result of certain defaults by the below named Borrower under the Loan Documents.

5. Date, Hour, and Manner of Sale: The Auction will be conducted on the Auction Date at 11:00 a.m. CDT virtually by online video conference using Zoom or similar platform (with a telephonic option for those who wish to dial in by phone only) (the “Video Platform”). Subject to applicable Federal, state, and local laws and rules related to the COVID-19 pandemic, there may also be the ability of qualified bidders to request to attend the sale in-person. The Trustee may elect to appoint a licensed auctioneer or other entity to conduct the Auction. The Auction may be recorded and/or transcribed.

6. Description of Property to be Sold: All of the right, title and interest of Borrower in all of Borrower’s assets described in the Loan and Security Agreement (the “Property”). The Property includes, without limitation, the following intellectual property of the Borrower:

- Any and all copyright rights, copyright applications, copyright registrations and like protections in each work or authorship and derivative work thereof, whether published or unpublished and whether or not the same also constitutes a trade secret (collectively, the “Copyrights”);

- Any and all trade secrets, and any and all intellectual property rights in computer software and computer software products;

- Any and all design rights that may be available to Borrower;

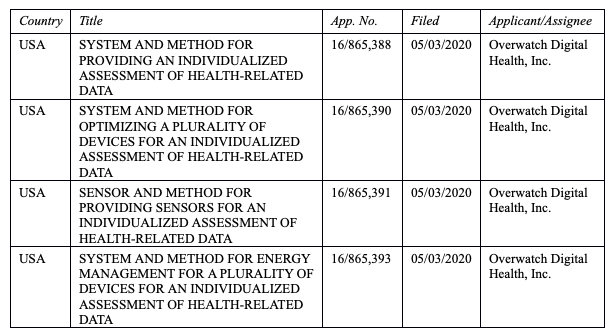

- All patents, patent applications and like protections including, without limitation, improvements, divisions, continuations, renewals, reissues, extensions and continuations-in-part of the same, including without limitation the patents and patent applications and any patents and patent applications claiming the priority thereto (collectively, the “Patents”), including the following patent applications and any patent resulting therefrom:

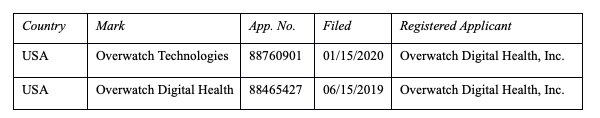

- Any trademark and servicemark rights, whether registered or not, applications to register and registrations of the same and like protections, and the entire goodwill of the business of Grantor connected with and symbolized by such trademarks (collectively, the “Trademarks”), including the following:

- All mask works or similar rights available for the protection of semiconductor chips, (collectively, the “Mask Works”);

- All computer programs and software (including source code, object code, algorithms and data) and any derivatives of the foregoing; licenses, covenants not to sue and the like relating to the foregoing; and any information, data, process, method, or know how that was developed by or on behalf of Borrower (or by any founder, shareholder, employee, consultant, independent contractor, officer, director or third-party on behalf of Grantor) and/or which was assigned to Borrower (collectively, the “Technology Rights”);

- Any and all claims for damages by way of past, present and future infringements of any of the rights included above, with the right, but not the obligation, to sue for and collect such damages for said use or infringement of the intellectual property rights identified above;

- All licenses or other rights to use any of the Copyrights, Patents, Trademarks, Mask Works, or Technology Rights and all license fees and royalties arising from such use to the extent permitted by such license or rights; and

- All amendments, extensions, and renewals of any of the Copyrights, Trademarks, Patents, Mask Works or Technology Rights.

The Secured Parties have a first-priority security interest in the Property. The total amount that due to the Secured Parties as of July 14, 2021, is $1,119,904.42. The Trustee may bid for the Property and credit bid against all or a portion of the total secured claim unless an agreement is reached with the Borrower. The Property will be sold free and clear of the liens of the Trustee and the Secured Parties and any subordinate security interests in the Property.

A complete description of the Property and related documents can be obtained by contacting the Agent as indicated herein.

7. Participation Requirements: In order to participate in the bidding process at the Auction and obtain admittance to the Video Platform, each person (a “Potential Bidder”) must deliver to the Agent at [email protected] and [email protected] by the Qualification Deadline:

- An executed confidentiality agreement in form and substance satisfactory to the Trustee (a “Confidentiality Agreement”);

- Current financial statements of the Potential Bidder or other documents that will show sufficient assets to be able to close on a purchase of the Property or other evidence of the ability to purchase the Property reasonably satisfactory to the Trustee;

- A deposit in the amount of $50,000 (the “Sale Deposit”) by bank wire transfer, certified or cashier’s check or another form of payment that the Trustee may agree in writing to accept will be required of all Potential Bidders wishing to participate in the Auction as a Qualified Bidder (as hereinafter defined). The Sale Deposit will be held in the Agent’s client trust account and will be credited against the purchase price of the Property on a dollar-for-dollar basis if the Qualified Bidder is the successful purchaser of the Property at the Auction. The Sale Deposit shall be subject to the provisions of Terms of Sale below. All deposits (except that of highest bidder and any backup bidder) shall be returned within three (3) business days of the conclusion of the bidding; and

- An agreement by the Potential Bidder and the representatives of the Potential Bidder taking part in the auction to being recorded. No representatives of the Potential Bidder may take part in the Auction without providing such agreement. Such agreement shall also designate a single individual authorized to speak on behalf of the Potential Bidder at the Auction.

A Potential Bidder that complies with the foregoing requirements shall be deemed a qualified bidder (each, a “Qualified Bidder”). The Trustee will be deemed to be a Qualified Bidder.

8. Information and Due Diligence: A Potential Bidder that executes a Confidentiality Agreement and provides information that demonstrates, in the Trustee’s sole discretion, that the Potential Bidder has the financial wherewithal to close on a sale of the Property will be permitted to perform due diligence by contacting the following representatives of the Agent: Lenard Parkins ([email protected]) and R. J. Shannon ([email protected]). The information provided to qualified, interested parties has been obtained from the Borrower or other parties. Neither the Trustee nor his agents or attorneys has independently verified such information, nor do they warrant the truth or accuracy of any statement made therein. Interested parties are solely responsible for performing their own due diligence to determine the nature, value, fitness for use and status of the offered Property through independent investigation by themselves and their legal and financial advisors.

9. Terms of Sale: At the Auction, the Property shall be offered for acquisition by Qualified Bidders. The Property will be sold at the public Auction to the highest Qualified Bidder. Agent reserves the right to permit, at its sole discretion, Qualified Bidders to participate telephonically in the auction. The Auction will be conducted by open bidding in the Video Platform and, if permitted, in-person at the offices of the Agent in accordance with the bidding procedures to be distributed by the Agent not less than one (1) business day prior to the Auction Date. The Auction will be recorded.

The Property shall be sold in one or more lots for cash at such price or prices and on such other commercially reasonable terms as the Trustee may determine in his sole discretion. Higher bids will continue to be entertained until the Trustee has determined that he has received the highest or best bid, in his sole discretion. The Trustee shall be permitted to bid at the sale and, notwithstanding any requirement herein that the sale of the Property be for cash, may credit its bid against all or a portion of his secured claim and become the purchaser of the Property. The Trustee reserves the right to reject all bids and terminate the sale or adjourn the sale to such other time or times as he may deem proper only by announcement on the date of sale or any subsequent adjournment thereof without further publication and impose any other commercially reasonable conditions upon the sale of the Property as he may deem proper. Payment will be accepted only by wire transfer of same day funds, or, in the case of purchase by the Trustee, credit against amounts due under the Loan Documents. Payment must be made in full (net of the Sale Deposit) within two (2) business days of the sale by a wire transfer of same day funds, or on such other terms as agreed by the Trustee in his sole discretion. The sale of the Property shall be effectuated by delivery of a Bill of Sale with no representations, no warranties (whether express or implied) and all Property sold, “as-is, where-is, with all faults.”

The Trustee, if he deems it advisable, will designate a second party as back-up bidder in the event that the successful bidder is unable to consummate the anticipated transaction. If, at any point, the successful bidder or backup bidder is unable to fulfill its commitments, its Sale Deposit will be forfeited to the Trustee. The Trustee may, in his sole and absolute discretion, waive this forfeiture.

10. No Warranties: The Property will be sold “AS IS, WHERE IS,” “WITH ALL FAULTS,” and “WITHOUT ANY WARRANTIES WHATSOEVER, EXPRESSED OR IMPLIED, INCLUDING, WITHOUT LIMITATION, A WARRANTY OF MERCHANTABILITY OR FITNESS FOR ANY PARTICULAR OR OTHER PURPOSE,” and subject to taxes, special assessments and liens that have been levied or assessed, and/or are unpaid or unsatisfied (none of which will be paid by the Trustee). The Property is being sold without recourse to the Trustee, his attorneys, or his representatives. The Trustee does not claim title to the Property being sold hereunder and disclaims any warranty of title, possession, quiet enjoyment, and the like in the sale.

The Trustee and Agent make no representation or warranty as to (i) state or condition of title, (ii) physical, financial, or environmental condition, (iii) existence, validity, or amount of any liens or claims senior to that of the Trustee or Secured Parties, or (iv) value of or income produced or that may be produced by the Property.

11. No Fees Payable: No person shall be entitled to any expense reimbursement, brokerage fee, breakup fee, “topping,” termination or similar fee or payout from the proceeds of the Sale.

12. Postponement of Public Sale: The Auction scheduled on the date set forth above may be postponed. In such event, an announcement of postponement of the scheduled sale will be made by Trustee at the currently proposed date and time of the Auction and by the Trustee contacting all Qualified Bidders by email.

13. For Additional Information: Please contact the representatives of the Agent, Lenard M. Parkins (713-715-1666; [email protected]) and R. J. Shannon (713-715-1664; [email protected]), if you seek any additional information regarding the Auction or the Property.

PARKINS LEE & RUBIO LLP

Lenard M. Parkins

R. J. Shannon

700 Milam STE 1300

Houston, TX 77002

[email protected]

[email protected]

(713) 715-1660

Attorneys for Clive Barrett, Trustee

EXHIBIT “A” – SECURED PARTIES

- Barrett Family Trust

- Onn Dodis

- Adiel Moyal

- Guy Duani

- Alon Lavie

- Gary Snow

- LAW Investment Holdings Pty Ltd ATF LAW Investment Holdings Trust

- Walker Family Superfund Pty Ltd ATF Walker Family Superfund

- Praha Nominees Pty Ltd.

- Mill Point Consulting Pty Ltd

- Leigh Mackinnon

- Ashikaga Pty Ltd

- John Funchess & John Funchess Jr.

- Simon & Robyn Melville

- Glenda & Matt Lazzarich

- Kruger Park Pty Ltd.

- Mr. Richard Peter Dowle

- Jed International P/L

- Bingopolous Super Fund

- L & S Fenton Superannuation Fund

- T&N ALABAKIS Superannuation Fund

- Assunta Tarulli

- Mrs. Louise Jane Hartwig

- Cardrona Energy Pty Ltd

- Peloton Advisory Pty Ltd

- Joel Bines

- Mossco Capital (Luxembourg) SARL

- Big Fish Mandurah Quay Pty Ltd

About DailyDAC

DailyDAC™ is the internet's oldest, most trusted, and most widely used provider of public notices of asset sales and case commencements, and other important notices involving companies in financial distress in the United States and Canada. DailyDAC™ public notices are used by bankruptcy trustees, chapter 11 debtors in possession, federal and state court receivers, assignees for the benefit of creditors, auctioneers, and secured parties disposing of their collateral under the Uniform Commercial Code or other state law trust (and their respective auction firms, law firms, and other agents). Learn more.

Many sales of distressed companies and distressed business assets are not widely advertised. If you are buyer of such companies or assets, you may be well served by becoming a paying subscriber to Distressed Deal Data™. Find out more.

Related Articles

PUBLIC NOTICE OF ASSIGNEE’S SALE: AUCTION OF ASSETS OF CHICAGO WICKER & TRADING CO.

PUBLIC NOTICE OF CHAPTER 11 SALE: Solar Biotech, Inc.

PUBLIC NOTICE OF UCC SALE: Secured Party Sale

NOTIFICATION OF CONTINUED ARTICLE 9 DISPOSITION OF NEWPORT EXCHANGE HOLDINGS, INC., NEH SERVICES, INC., OTA FRANCHISE CORPORATION, AND OTA REAL ESTATE, INC. COLLATERAL

PUBLIC NOTICE OF UCC SALE: Wildcat LLC

PUBLIC NOTICE OF UCC SALE: Pelrous Fund REIT, LLC

Session expired

Please log in again. The login page will open in a new tab. After logging in you can close it and return to this page.