|

|

|

|

A debtor in chapter 11 proceedings may face dissent from a group of creditors who will not get paid in full under the debtor’s proposed reorganization plan. Can a debtor obtain confirmation of its proposed reorganization plan despite the dissent from its creditors? Lindsey Young Distinguished Professor of Law George Kuney lays out the legal requirements for such a “cramdown” in the article “Cram Down: An Impaired Class of Claims Says ‘No’ But the Plan is Confirmed Anyway.”

|

|

|

Many companies, and most of any size, use borrowed funds as part of their capital structure. Depending on the nature of the business, its size, time in business, whether it has adequate collateral, and other factors, a business has a myriad of options when borrowing funds.

Want a guided tour of the various borrowing options available to businesses, from both a business and legal perspective? There’s a webinar for that! Check out the Financial Poise Webinar Series, Borrower or Lender Be and learn the advantages and disadvantages of different types of loans, how to select the right loan for your business, how to negotiate terms, and what happens in the event the loan is defaulted upon.

Financial Poise Webinars provide quality education by leading experts in an accessible, even entertaining way. Each is an hour long. Each comes with fantastic PowerPoint. Each is pretty entertaining (at least as compared to most seminars on the topic). And each is only $19.99. Come learn with us!

|

|

|

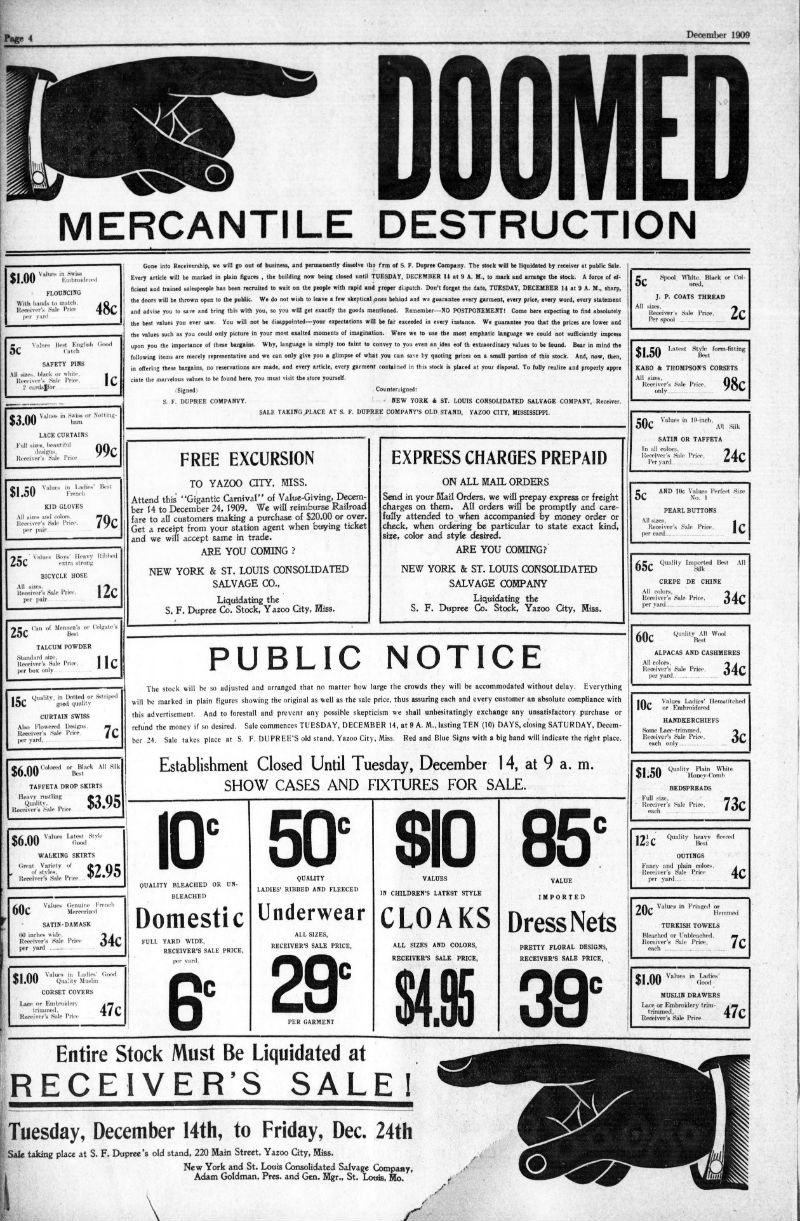

Before DailyDAC, bankruptcy sales were generally only advertised in local newspapers, resulting in far less recovery for creditors. In commemoration of those dark days, which are thankfully behind us, we present a classic newspaper advertisement:

Image Source: The Lexington advertiser. [volume] (Lexington, Miss.), 10 Dec. 1909.

Chronicling America: Historic American Newspapers. Lib. of Congress. https://chroniclingamerica.loc.gov/lccn/sn84024271/1909-12-10/ed-1/seq-14/

Image Source: The Lexington advertiser. [volume] (Lexington, Miss.), 10 Dec. 1909.

Chronicling America: Historic American Newspapers. Lib. of Congress. https://chroniclingamerica.loc.gov/lccn/sn84024271/1909-12-10/ed-1/seq-14/

For information on providing effective yet inexpensive public notice of your sale, click here.

|

|

About the Opportunistic Deal Database

|

Vulture Investors Take Note:

Looking to buy companies out of bankruptcy? Assets of financially distressed companies in receivership, assignment or from lenders who have foreclosed on, and are selling, their collateral under Article 9 of the UCC? Search for excess assets resulting from plant closings? Targeting other sellers who need to sell urgently and other opportunistic/special situations?

Check out DailyDAC's Opportunistic Deal Database (ODD). The ODD culls such opportunities.

Subscribe here for access

|

|

The deals listed here were added to the ODD throughout the seven day period ending this past Sunday. The number in parentheses next to each deal is its unique ID number, included so our paid subscribers can easily find these deals on our website.

|

Secured Party Sales

- 21 properties - Mineral & royalty interests - (21665)

- Industrial trailers - Multiple lots - (21666)

- Eight spot mobile home park - (21664)

- 114 storage unit complex - (21663)

- Automotive equipment - (21662)

|

Private Company Sales

- Specialized roofing manufacturing & installation company - (21667)

- Specialty consumer electronics manufacturer - (21671)

- Commercial woodwork & cabinetry company - (21670)

- Custom leaf spring manufacturer - (21669)

- Machine shop (w/real estate) - (21668)

|

Assignment for the Benefit of Creditors Sales

- Trucking & logistics services company - (21646)

- Business/corporate services provider - (21642)

- Lighting showroom & fan dealer - (21641)

- Steel services company - (21643)

- Travel agency - (21644)

|

Chapter 11 - 363 Sales

- Laminates manufacturing facility - (21728)

- Corporate shares - Multiple lots - (21700)

- Glass manufacturing business - (21719)

- Trucking & hauling business - (21705)

- Corporate purchased assets - (21702)

- Real estate developer - (21730)

|

Chapter 11 - Investment Banker Application Filed

- Digital marketing company - apartment industry - (21741)

- Designer of technology systems - (21738)

- Biopharmaceutical company - (21736)

- Energy services company - (21740)

- Publishing company - (21737)

|

Chapter 11 - Case Filing Indicates Future Asset Sale

- Grove mine & undeveloped cypress project - (21745)

- Healthcare services holding company - (21744)

- Chain of natural foods retail stores - (21748)

- Home furnishings retailer - (21746)

- Nursing home - (21742)

|

Chapter 7 - Sale of Business Assets

- Pharmaceutical compounding equipment & supplies - (21732)

- Remnant assets - Steel services company - (21724)

- Multiple industrial vehicles - (21722)

- Music equipment & supplies - (21734)

- Dental practice - (21726)

|

Chapter 12 Bankruptcy

- No New Deals This Week

|

|

|

|

|

Rating Agency Alerts/Other Signs of Distress

- Provider of medical products & services - (21676)

- Financial & capital services company - (21679)

- Terminal/slot machine operator - (21681)

- Wastewater treatment business - (21680)

- Cannabis-related magazine - (21677)

|

Auctions

- Late model CNC Aerospace equipment - (21638)

- Automotive parts manufacturer - (21651)

- Late model stamping presses - (21640)

- Fabrication facility - (21650)

- CNC machine shop - (21647)

|

Other Interesting Sales

- Acquirer of technology patents & intellectual property - (21685)

- Business acquisition services company - (21684)

- Broadband communications provider - (21686)

- Cryptocurrency exchange business - (21683)

- Motorboat distributor - (21682)

|

Bulk Sales

- Organic chocolate candy retailer - (21661)

- Commercial beverage license - (21659)

- Women's clothing boutique - (21660)

- Coffee/tea restaurant - (21655)

- Restaurant/diner - (21657)

|

Receiverships

- 85,588 SF Industrial Building - (21637)

- 1,648 SF Industrial Building - (21635)

- 3,300 SF Specialty Building - (21636)

- 2,800 SF Office Building - (21633)

- 1,200 SF Office Building - (21634)

|

Mass/Significant Layoffs

- Engineering & construction firm - (21693)

- Oil & gas production company - (21692)

- Oil & natural gas company - (21691)

- Precision machine shop - (21689)

- Stevedoring company - (21690)

|

Plant/Facility Closings

- Manufacturer of windows & doors - (21695)

- Logistics services company - (21697)

- Sports equipment dealer - (21698)

- Distribution facility - (21699)

- Trucking company - (21696)

|

|

|

|

| |

DailyDAC is a publication of DailyDAC,LLC. DailyDAC LLC is strictly a research publishing firm and falls within the publisher's exemption of the definition of an "investment advisor" and is of general and regular circulation. DailyDAC is not a registered broker/dealer and it is not an investment bank or business broker. DailyDAC is not a solicitation or offer to buy or sell any securities. All content in this email is copyright 2020 by DailyDAC, LLC and may not be reproduced without written permission of DailyDAC, LLC but this email may be forwarded freely in its entirety.

DailyDAC, LLC provides continuing education and information for business owners and executives, accredited investors, and their respective trusted advisors (primarily attorneys, accountants, and other financial and business advisors.) For more information about DailyDAC LLC, click here.

|

DailyDAC, LLC

1954 First Street, Suite 178

Highland Park, IL 60035

847-463-9530

[email protected]

|

|

|

|

|