- Home »

- Business Bankruptcy »

- Convertible Securities: Appealing in this Uncertain Market

Convertible Securities: Appealing in this Uncertain Market

The market has changed a lot since our last look at convertible bonds about six months ago. Not only has the stock market been shaken by the potential fall-out from the Covid-19 stay-at-home orders, but also interest rates have fallen sharply. The market has shown resilience, but risks clearly remain as the economic recovery may not happen as quickly as investors expect.

Convertible bonds and convertible preferred stocks can provide investors with possible participation in future gains in the underlying common stock, along with attractive yields, while providing some measure of downside protection. Because each security is convertible into a specified number of common shares, if the common stock goes up, the convertible security will trade up as well. Downside protection comes from the securities’ cash coupons and seniority in the capital structure. Unless the issuer defaults, the holder of the convertible will be paid at least the security’s face value at maturity even if the stock has not risen.

For example, ABC Industries’ $1,000 par value bond with a 5% coupon may trade at $900, reflecting only its worth as a bond. If it is convertible into 50 shares of common stock, and those shares trade at $17, the conversion value is $850 (or, 50 shares x $17). The bond is said to be trading at a 6% conversion premium (or, $900 price/$850 conversion value). But, if the share price rises to $26, then its value will increase to $1,300 (or, 50 shares x $26), and the bond will trade in-step with the underlying common stock until it is converted into stock. Moreover, it will still pay the 5% coupon until conversion. If the stock does not go up, the bond will still be worth $1,000 at maturity. The lower the conversion premium, the more the convertible’s price will follow the underlying share price.

Convertible preferred shares have similar features, except that they are junior to the company’s debt securities and do not always have a guaranteed face value, which can limit their defensive value. Nevertheless, they often pay attractive dividends, which are contractually fixed (unlike common stock dividends) and usually must be paid in full before common shareholders get any dividends. They might also be seen as a way to participate in the common stock while earning a higher dividend in the interim. Mandatory convertible preferred shares require holders to convert to common stock, allowing them to be treated as equity, rather than debt, by rating agencies. This type of preferred shares generally offers a range of conversion ratios which provides more variability around their underlying conversion value.

A few caveats: even convertible bonds are often junior to other debt of the issuer, and so in a bankruptcy, convertible securities holders may not receive much recovery (although they would still come ahead of common stockholders). Also, most convertible bonds are callable by the company, which means the company can force you to convert the bond to equity, but the company is only likely to do that if the stock has risen significantly.

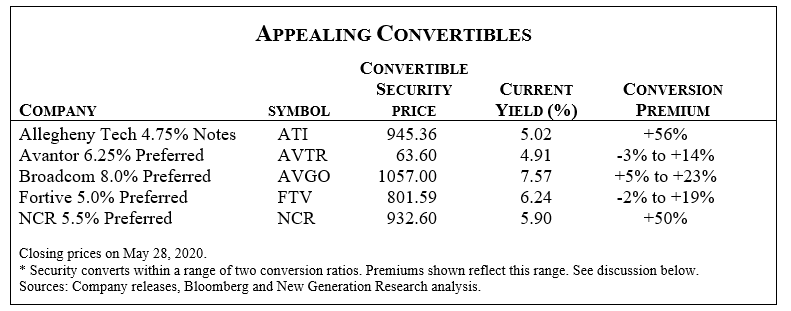

Listed below are five interesting convertible securities with relatively high yields.

Allegheny Technologies 4.75% Convertible Senior Notes due July 2022 – Allegheny is a producer of specialty metals including titanium and stainless steel. With over 70% of its revenues coming from the commercial jet market, Allegheny’s prospects have weakened along with aircraft demand. However, it is likely to generate free cash flow this year, has a manageable amount of debt and will eventually participate in the industry’s recovery. The convertible notes mature at par in two years, offering 20% upside, even if the stock doesn’t rise, as well as an attractive yield. If the stock rallies to about $14.50, the bond will begin trading as a stock, providing further upside potential.

Avantor 6.25% Series A Mandatory Convertible Preferred Stock – This company has a valuable niche as a provider of materials, consumables and related equipment and services to biopharma, healthcare and advanced materials companies. In May 2019, Avantor completed a $2.9 billion initial public offering at $14. The preferred shares offer an appealing 5% yield (compared to no yield for its common shares). Holders will have their preferred shares automatically convert the $50 in liquidation preference (or, face value) into either 3.04 or 3.57 common shares in May 2022. With Avantor’s steady growth prospects, these preferred shares offer investors an opportunity to participate in the common stock’s upside while enjoying a generous yield.

Broadcom 8.0% Series A Mandatory Convertible Preferred Stock – Broadcom designs and produces semiconductors, network infrastructure and software. It purchased the corporate security operations of Symantec for $10.7 billion in 2019. The convertible’s high yield is appealing when compared to the 4.6% yield on the common stocks. Holders will need to convert the $1,000 in face value by September 2022, with the conversion ratio ranging between 3.03 and 3.54 shares.

Fortive 5.0% Series A Mandatory Convertible Preferred Stock – Fortive was spun-off from Danaher Corporation in 2016. The company acquires attractive businesses in a diverse range of industries, using a successful capital allocation strategy and the “Danaher Business System” that focuses on quality, cost and other key performance metrics. Due to Covid-19, Fortive has delayed two planned spin-offs. The preferred shares convert in July 2021 into between 10.90 and 13.33 shares of common stock. With the company’s attractive long-term future, these convertibles offer a good yield plus participation upon conversion.

NCR 5.5% Series A Convertible Preferred Stock – NCR’s primary business, producing bank ATM machines and providing related services, may be temporarily weakened but should eventually recover. NCR’s convertible preferred shares offer an interesting way to participate, partly by paying a superior dividend yield to the common (which pays no dividend). Holders may convert the securities into 33.3 common shares at their option, with no time limit, providing plenty of time to wait. Supporting the value, and the high 50% conversion premium, is the right that holders have to redeem the convertibles at the $1,000 face value after March 2024.

[Editor’s Note: This article is reprinted from the June edition of The Turnaround Letter. The goal of The Turnaround Letter, founded in 1986, is to provide insight into potential turnaround situations and to recommend stock purchases that it feels have potential for large and/or imminent increases. Subscribe here and enter “FinPoise” at checkout for a discount up to 20%. Disclosure: DailyDAC receives a share of sales associated with the use of this code.]

About Reprinted by permission from The Turnaround Letter

No author bio available. Check LinkedIn for more information.

View all articles by The Turnaround Letter (reprinted with permission) »

Related Articles

The Fisker Case: My Credit Bid Capped at the Amount I Paid for the Debt?

Bankruptcy Considerations in a Collections Action

The Elegant Swan and Clumsy Duck: What is Recharacterization in Bankruptcy?

Determining the Collateral Value of a Secured Claim

Finding Truth in a Debtor’s Balance Sheet: Analyzing Assets, Liabilities, and Equity

Demystifying Administrative Expenses in Bankruptcy

Session expired

Please log in again. The login page will open in a new tab. After logging in you can close it and return to this page.