- Home »

- Business Bankruptcy

Business Bankruptcy

Secured creditors and buyers of distressed assets don’t have to worry about courts limiting their credit bids, but one Delaware case is cause for concern.

Creditors looking to pursue a collections action should understand how Chapter 7 and Chapter 13 bankruptcy processes can affect efforts to collect.

A court may recharacterize a creditor’s debt claim as an equity interest. This recharacterization often has a significant impact on creditor claims.

Knowing the collateral value of a secured claim is important. It will impact how the secured creditor is treated under the plan.

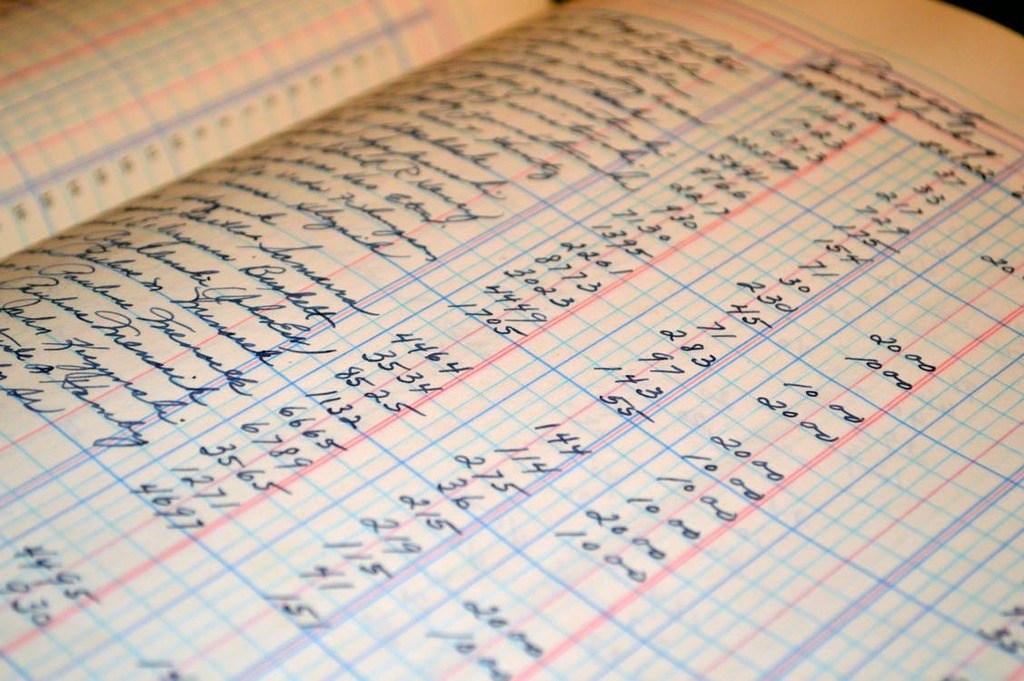

Learn how to read a balance sheet, or more importantly, how to read between the lines of the balance sheet assets, liabilities, and equity.

Administrative expenses can qualify as priority claims for unsecured creditors. What are the 3 categories of expenses in chapter 11 bankruptcy cases?

When a seller of real property files for bankruptcy the purchaser has rights under the bankruptcy code and as an executory contract.

Subchapter V works. It saves businesses. It helps the people that own those businesses. And it is cheap and fast, at least compared to “traditional” chapter 11.

Do you know how much your business is worth? A business appraiser can give you an objective outsider’s view and also venture an opinion on its trajectory.

In 2023, commercial Chapter 11 filings rose by 72% as compared to 2022. Read more about this surge and what to consider in 2024.