- Home »

- Investing in Distressed Businesses »

- Analyzing Executory Contracts: Can AI Save Us from The Contract Tsunami?

Analyzing Executory Contracts: Can AI Save Us from The Contract Tsunami?

The Overlooked (Giant) Asset Class: Executory Contracts

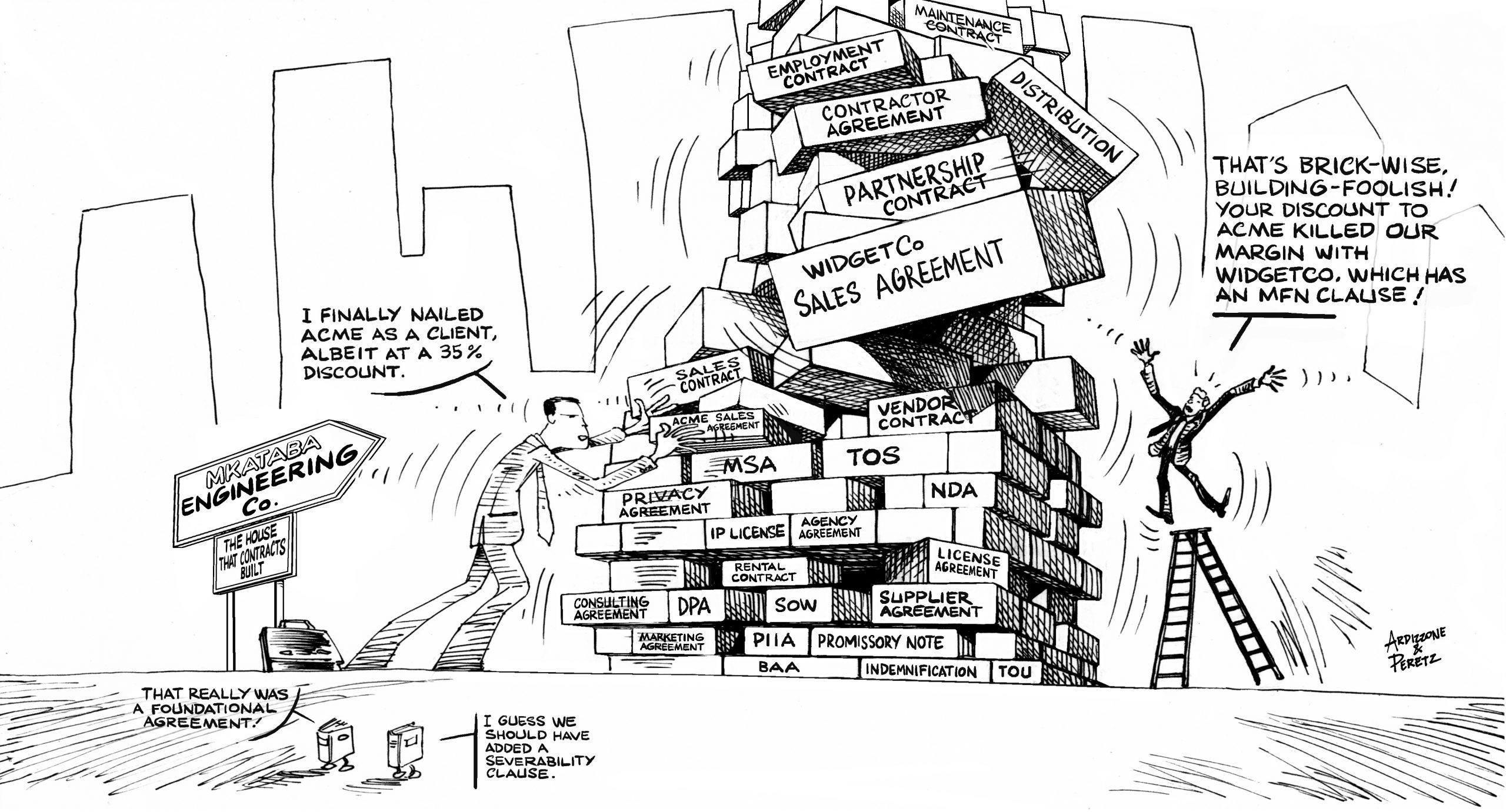

In today’s world, one of the most important sources of assets and liabilities for a debtor is its executory contracts. Companies that were once heavy with assets and employees now have a much lighter balance sheet accompanied by many more business agreements enabling (or causing) them to utilize certain assets and services, exercise particular rights and options, and fulfill certain requirements.

Financial engineering and more specialized capital markets have turned monolithic companies into asset-light entities reliant on leased space, equipment, and even leased personnel. Management consultancy McKinsey & Company reports that almost all industries have a large majority of their spending locked in contracts. Sectors like utilities, aerospace and defense, and food manufacturing may have up to 90% or more of their annual revenues represented dependent upon contracts with suppliers and vendors.

Essential intellectual property, such as core software to operate the debtor’s business, is also likely tied to a subscription contract that can terminate or change terms over time. Venture capital firm Kleiner Perkins conducted a study revealing the number of different cloud services used by different business departments, with Corporate Marketing using 91, Human Resources using 90, Finance and Accounting using 60, and Sales using 43 more cloud services.

This use of cloud service persists across many industries. For example, the average retail, hospitality, and restaurant company uses 1,206 cloud applications, while the average financial services firm uses 1,170 cloud applications. Meanwhile, the typical manufacturer uses 1,092 cloud applications.

What this trend means is that you cannot understand a debtor and its assets unless you can understand its executory contracts.

Contracts = Revenue

If you are considering purchasing or investing in a debtor, one of the first areas to focus your diligence is on the debtor’s client contracts. Certain clauses in these agreements can control whether you will be getting a treasure or the booby prize. In this section, we’ll discuss key contract clauses upon which you should focus when analyzing executory contracts.

1. The Price is Right? Or is it?

Whatever the debtor is selling, you need to make sure that sales will be profitable. For many types of services and goods, price depends on volume. Unfortunately, many companies forget to review their agreements after they are signed in order to track the buyer’s volume commitments and verify whether those are met. By cross-referencing the volume commitments with actual sales, you may discover substantial undercharging of existing clients.

Certain major clients of the debtor may have a Most Favored Nation (MFN) clause built into their contracts with the debtor. It is essential to find these clauses, because overlooking one can result in a dramatic loss of revenue down the road. An MFN Clause typically requires that the customer receive a price discount whenever anyone else receives a lower price from a seller. If the debtor, perhaps due to its faltering financial condition, is forced to lower prices to new clients in order to keep revenue flowing, this will trigger the need to give an equivalent discount to its large clients who have an MFN clause in their agreement. The result will be a potentially dramatic drop in revenue from its customer base.

2. By the Very Fact

For those doing business with a debtor, the most commonly referenced clause in contracts is language related to the consequences of a bankruptcy filing. It is common to see a wide range of commercial contracts stating that the customer has the right to terminate or modify its agreement with the supplier if the supplier declares bankruptcy. Should you write off the expectation of future revenue from clients with such a clause in their agreement with the debtor? Not so fast.

The U.S. Bankruptcy Code provides that contractual clauses triggering an automatic termination of an agreement upon a bankruptcy filing (called an Ipso Facto clause) are per se invalid. That means you can disregard them in most instances.

3. Service Levels Matter

Because so many agreements provide ongoing service requirements rather than a one-time sale, customers often insist on performance standards called Service Levels. It is imperative to study the service level commitments of a debtor, because flagging cash flow may have caused it to miss many obligations. And the result of such a miss could be lost revenue or even cancellation of the agreement. For example, companies providing an online service may commit to a certain amount of advance notice prior to scheduled downtime. A failure to provide this notice may necessitate a rebate to clients.

4. Beware the Unknown Unknowns

Many companies are quick to point out that one need only review one of their agreements to understand all similar (e.g., sales, procurement) agreements. Unless the company provides most of its goods or services to individual consumers, this statement merely reflects aspirations and not reality.

In business-to-business agreements and contracts representing large dollar amounts, there is often extensive negotiation prior to concluding a sale. The result of the negotiation is typically reflected in modified contract terms. Additionally, new versions of contract templates are promulgated on a regular basis. And acquisitions of other companies bring even more template types and modifications to the collection.

The result is that companies are deluded into thinking they know the key terms of all their sales agreements because they currently provide a template agreement to their sales team, when the reality is that the final signed agreements have substantial variation among the key terms. The solution: read all the contracts themselves rather than relying on a false assertion about templates.

AI to the Rescue?

Computers have beaten chess champions and triumphed on Jeopardy! Can’t they read all those boring contracts of the debtor for us? The answer: yes, they can help, but don’t rely on them when analyzing executory contracts.

There have been remarkable advances in the development of natural language processing systems to understand speech and text, however these systems still require expert human help. And, in the case of analyzing contracts, that assistance has to come from highly trained attorneys.

Creators of machine learning tools to analyze contracts sometimes boast that they provide 95% Recall or 92% Precision. These terms sound impressive in the abstract—until you learn what they really mean.

Recall refers to a measurement of whether a piece of software casts a wide enough net in hunting for key information in a contract. A 95% Recall score when hunting for a particular contract term, such as an MFN clause, means that the program only missed 5% of the instances where an MFN clause was mentioned. Unfortunately, a high Recall program often includes many false alarms—flagging lots of clauses that are not an MFN clause. In order to work through the false alarms, you need trained attorneys. More false alarms require more attorneys.

A model claiming high Precision is less likely to have false alarms because it is optimized for only producing correct answers. Thus, a 89% precision model would only yield false alarms 11% of time. Unfortunately, there is often a cost to such high Precision: lots of potentially correct results are skipped because there is not a 100% certainty that these results will not be deemed a false alarm. For example, a contract containing a clause entitled Best Price clause, which has the same substantive terms as an MFN clause, might be ignored by a high Precision model, because the machine is not certain that Best Price clause has the same meaning as MFN.

While it sounds impressive to have software achieve targets, albeit perhaps only on one metric, at 90% or above, it’s important to map this score to a real world impact. If your company has 20 locations, would it be acceptable to mess up the lease for one of them, perhaps at the flagship store? Not likely so for most companies. However a score of 95% means that one out of twenty is incorrect. For big ticket contracts, that error rate may be unacceptable.

When you hear about fantastical percentages of precision and recall, you should request to upload a heterogeneous sample of your own contracts to their system and run a test. Often you will find that these high percentage results can only be attained when analyzing very limited types of contracts from a small group of sources.

The Solution to Analyzing Executory Contracts? Combine AI and Experts

The solution to Recall and Precision problems is to combine artificial intelligence tools with expert attorneys who are trained to use the tools and will verify all of the results. Always include highly trained attorneys as part of the cost. If an artificial intelligence tools provider will not commit to having attorneys validate each and every output from its software, then you need to budget for the cost of those attorneys if you want accurate and complete results. A project involving 2,000 contracts might require paying several highly skilled attorneys for several months to validate the results—an expensive proposition. Always keep the total cost of ownership in mind when evaluating tools for analyzing executory contracts.

The best way to solve the problem is to purchase solutions, rather than tools. Define which contracts you need analyzed and what contract terms you need to study. Then tell the provider of any artificial intelligence tools to submit a bid that includes attorney review of each agreement. Doing so will get you an apples-to-apples comparison between providers of train-it-yourself tools who compared to an artificial intelligence company that has actually made the heavy investment in finding expert contract law attorneys and training them on its system.

Where to Begin

Encourage the entity in possession of the contracts to kickoff the analysis. If the debtor is engaged in a section 363 sale or seeking outside financing or an M&A event, it’s likely that a data room will be put together. While money is tight, if the debtor engages an AI contract intelligence vendor and dedicated attorneys to train it, the result should still be far more cost-effective than retaining a large law firm to read thousands of agreements at the cost of $500 per hour. And the debtor can use the results of the analysis to maximize the value it gets from those contracts, for example by not missing customer renewal and upsell opportunities, on an ongoing basis.

[Editor’s Note: To learn more about this and related topics, you may want to attend the following webinars: Opportunity Amidst Crisis – Buying Distressed Assets, Claims, and Securities for Fun & Profit and How to Read a Balance Sheet – And Why You Care!]

©All Rights Reserved. November, 2020. DailyDACTM, LLC

About Neil Peretz

Neil Peretz has served as general counsel of multiple companies, as well as a corporate CEO, CFO, and COO. Outside of the corporate sphere, he co-founded the Office of Enforcement of the Consumer Financial Protection Bureau and practiced law with the US Department of Justice and the Securities and Exchange Commission. Peretz holds a JD…

Read Full Bio » • View all articles by Neil »

Related Articles

The Fisker Case: My Credit Bid Capped at the Amount I Paid for the Debt?

The Commercial Receivers Association Prepares to Celebrate its Second Annual Conference in Palm Beach, FL August 18-21, 2024

LLC Membership Interests in Chapter 11: Can They be Sold Over Other Members’ Objections?

Solvent Debtor? A Chapter 11 Debtor Need Not Be Broke

Dealing with Corporate Distress 17: Focus on Assuming & Rejecting Executory Contracts & Unexpired Leases in Bankruptcy

Dealing with Corporate Distress 16: Overview of Bankruptcy Code § 365

Session expired

Please log in again. The login page will open in a new tab. After logging in you can close it and return to this page.